9 1

Bitcoin and Ether Traders Position for Downside Volatility This Summer

Traders in bitcoin (BTC) and ether (ETH) are preparing for potential downside volatility amid expectations of bullish price action this summer. Key points include:

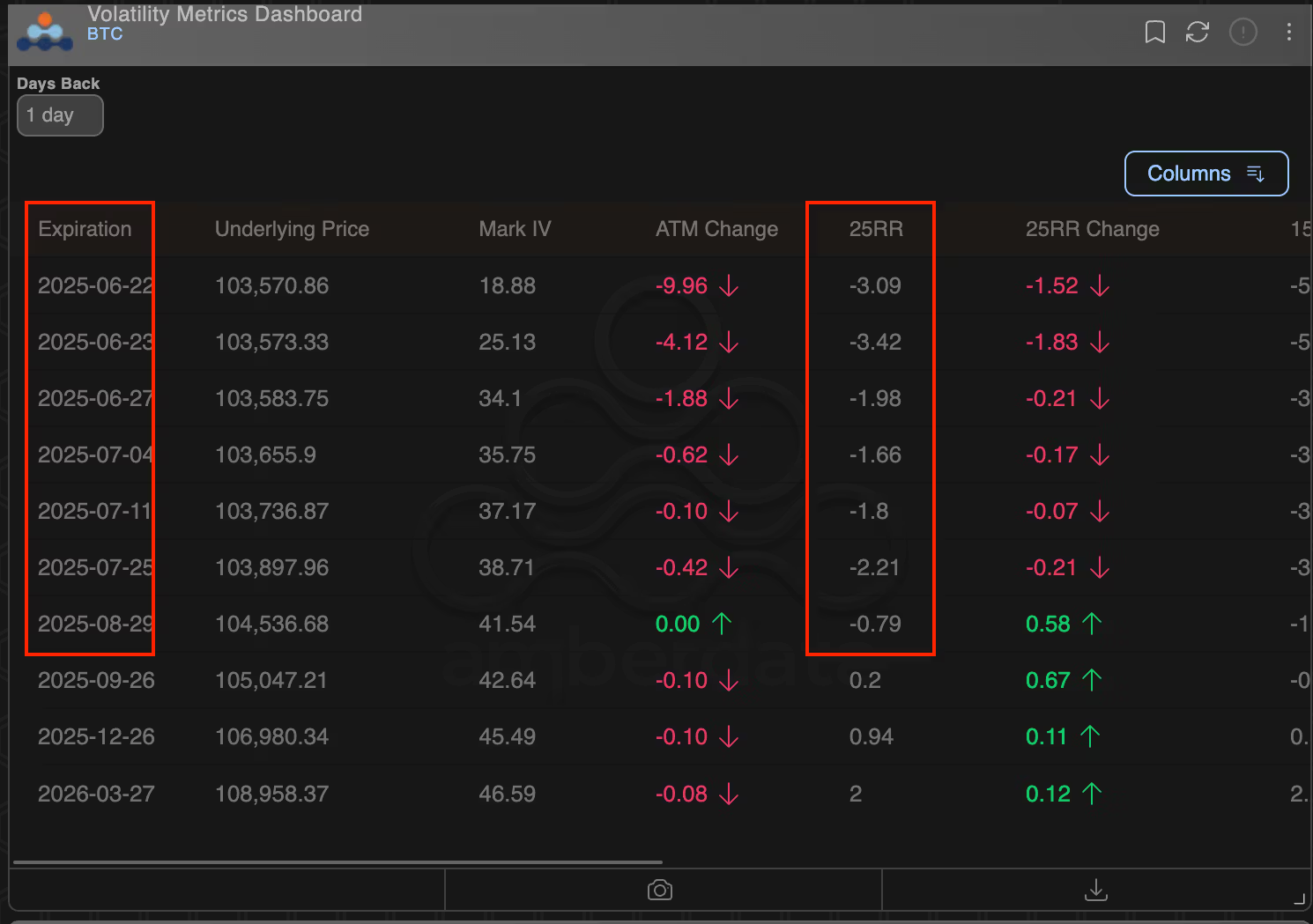

- The 25-delta risk reversal strategy indicates a preference for put options, suggesting hedging against price declines.

- BTC's risk reversals for June to August are negative, showing a demand for protection over bullish bets.

- In ETH, puts are more expensive leading to July expiry.

- Traders use put options to hedge long positions in spot and futures markets.

- Market note from QCP Capital highlights active hedging by long holders in both BTC and ETH.

- Recent trades on the Paradigm platform included bearish strategies for BTC and ETH.

- BTC has been trading above $100,000 for over 40 days but faces profit-taking and miner selling pressure.

- BTC closed below its 50-day moving average, raising concerns about further price drops.

- Some analysts expect BTC to potentially rally to $130,000-$135,000 by Q3 based on strong buying pressure indicators.