5 0

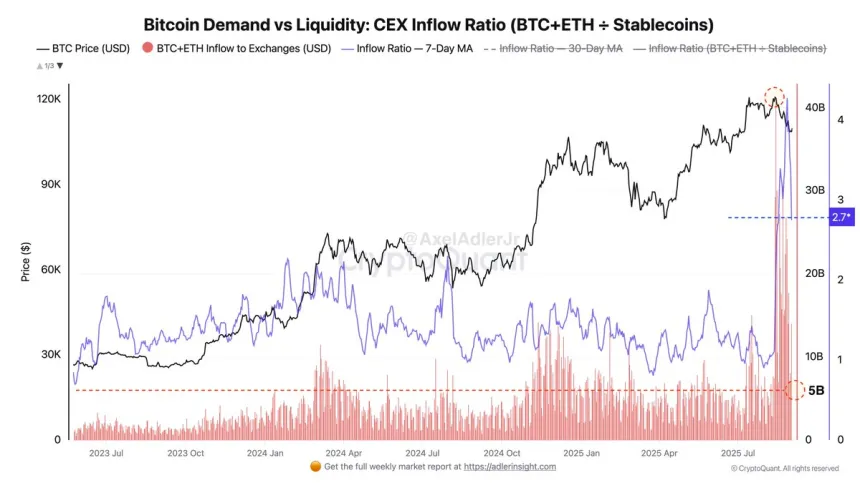

Bitcoin and Ethereum Inflows to Exchanges Surge Amid Weak Stablecoin Demand

Bitcoin is currently trading just above $110,000 amidst heightened market volatility. Analysts note this level as critical support, with investor sentiment turning cautious due to increasing bearish pressure.

Key points include:

- Capital is shifting from Bitcoin to Ethereum, causing concern among Bitcoin investors about potential loss of market dominance.

- Recent data shows a rise in BTC and ETH inflows to exchanges post Bitcoin's all-time high of $124,000, while stablecoin inflows remain low, indicating profit-taking.

- The Inflow Ratio (BTC+ETH ÷ Stablecoins) has spiked to 4.0×, suggesting excess supply is outpacing new liquidity, contributing to selling pressure.

- The ratio has since decreased to around 2.7× with daily inflow volumes at approximately $5 billion, still indicating insufficient demand to support upward price movement.

Current Price Dynamics

Bitcoin's price is near $111,192, showing signs of recovery after falling below $108,000 last week. Immediate resistance is at the 100-day SMA (~$111,737). Key resistance levels are:

- 50-day SMA (~$115,638)

- Local peak around ~$123,217

Support levels are identified around $108,000 and the 200-day SMA (~$101,460). A drop below $108,000 may lead to significant losses towards $100,000. Current consolidation indicates that upward momentum requires a break above $115,000, while maintaining above $108,000 is crucial to avoid further declines.