Bitcoin Expected to Reach $150,000 to $160,000 by Year-End 2025

Price Outlook

Forecasts for bitcoin in 2025 suggest a target range of $150,000 to $160,000. This is influenced by:

- A potential pivot in Fed policy and expectations for lower interest rates.

- Favorable liquidity conditions.

- A positive regulatory environment for cryptocurrencies.

- The Trump administration's recent allowance for cryptocurrencies in 401(k) plans, targeting the $9 trillion retirement market.

Ongoing Crypto Catalysts

- Liquidity conditions: Continued injections from the PBOC and global M2 expansion.

- Institutional interest: Increased corporate investment in bitcoin and growth in bitcoin and ether funds.

- ISM survey: Expected rise above 50.0, historically correlating with "alt season."

Quantitative Models and Risks

Current quantitative models indicate potential upside for bitcoin and the overall market:

- The Vanguard model shows long conviction signals.

- Weekly closes above $119,000 would reinforce bullish sentiment.

Risks

- Negative U.S. data could trigger stagflation fears.

- A significant pullback in the S&P 500 targeted around 6,660.

- Potential negative headlines in Sino-U.S. trade relations.

- Profit-taking from ETF holders if bitcoin surpasses $150,000 or $160,000.

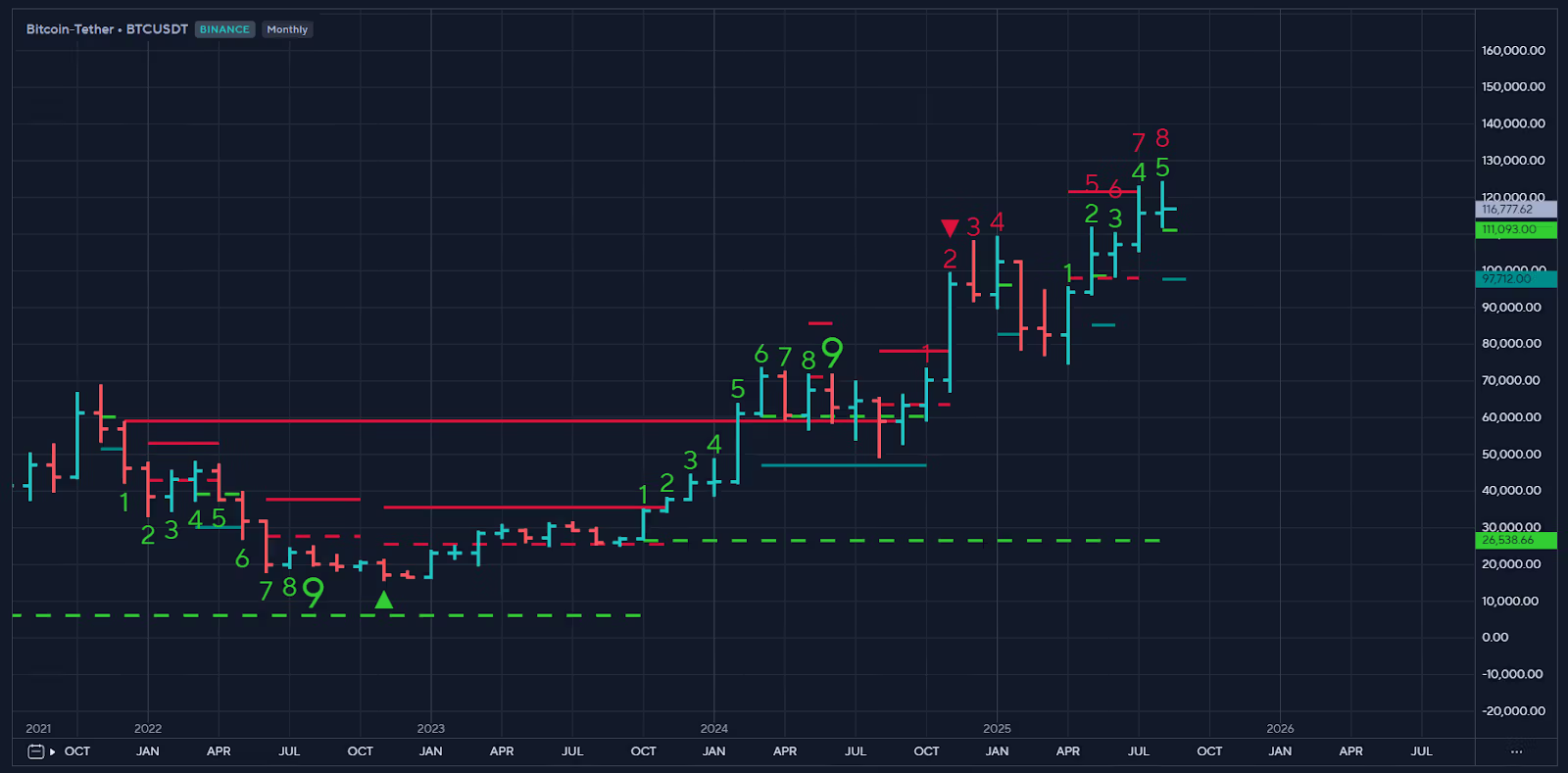

Insights from Demark Indicator

The Demark TD sequential monthly chart indicates a potential top approaching year-end, with signals pointing to strong overbought conditions at setups 9 and countdown 13.

Crypto Total Market Cap

The crypto market capitalization is projected to reach:

- An initial target of $5 trillion in Q3.

- A broad-based rally among the top 150 cryptocurrencies.

- Limited downside risk below $4 trillion post-breakout.

Conclusion

Bitcoin and the broader cryptocurrency market are positioned for significant price increases, with projections between $150,000-$160,000 and a total market cap of $5 trillion. Key risks include rising CPI readings and trade negotiation halts between the U.S. and China, though an extension of negotiations is anticipated. Overall, positive developments support expectations for strong price appreciation through year-end.