7 0

Bitcoin Eyes $95K as Gold Stalls After Recent Rally

The crypto market faced a rally stall following U.S. Treasury Secretary Scott Bessent's comments on prolonged trade negotiations between the U.S. and China.

- Bitcoin (BTC) rose 2.6% in 24 hours and 12.2% over the week, trading at $93,600.

- The CoinDesk 20 index increased by 4.2%, with Sui (SUI) gaining 24%, and Cardano (ADA) and Chainlink (LINK) up 7% each.

- Crypto stocks like Bitdeer (BTDR) and Core Scientific (CORZ) experienced reduced gains, closing up around 4%.

- President Trump's recent remarks suggested potential tariff reductions on China, but Bessent stated no unilateral offers were made.

- Investor demand for U.S.-listed spot BTC ETFs resulted in nearly $1.3 billion in net inflows this week, marking the strongest day since mid-January.

- Matt Mena from 21Shares noted that institutional investment is driving the current rally as a safe haven amid traditional market uncertainties.

- Gold declined 2.5% to $3,290 per ounce after rising 35% over four months, which may indicate shifting market dynamics favorable for Bitcoin.

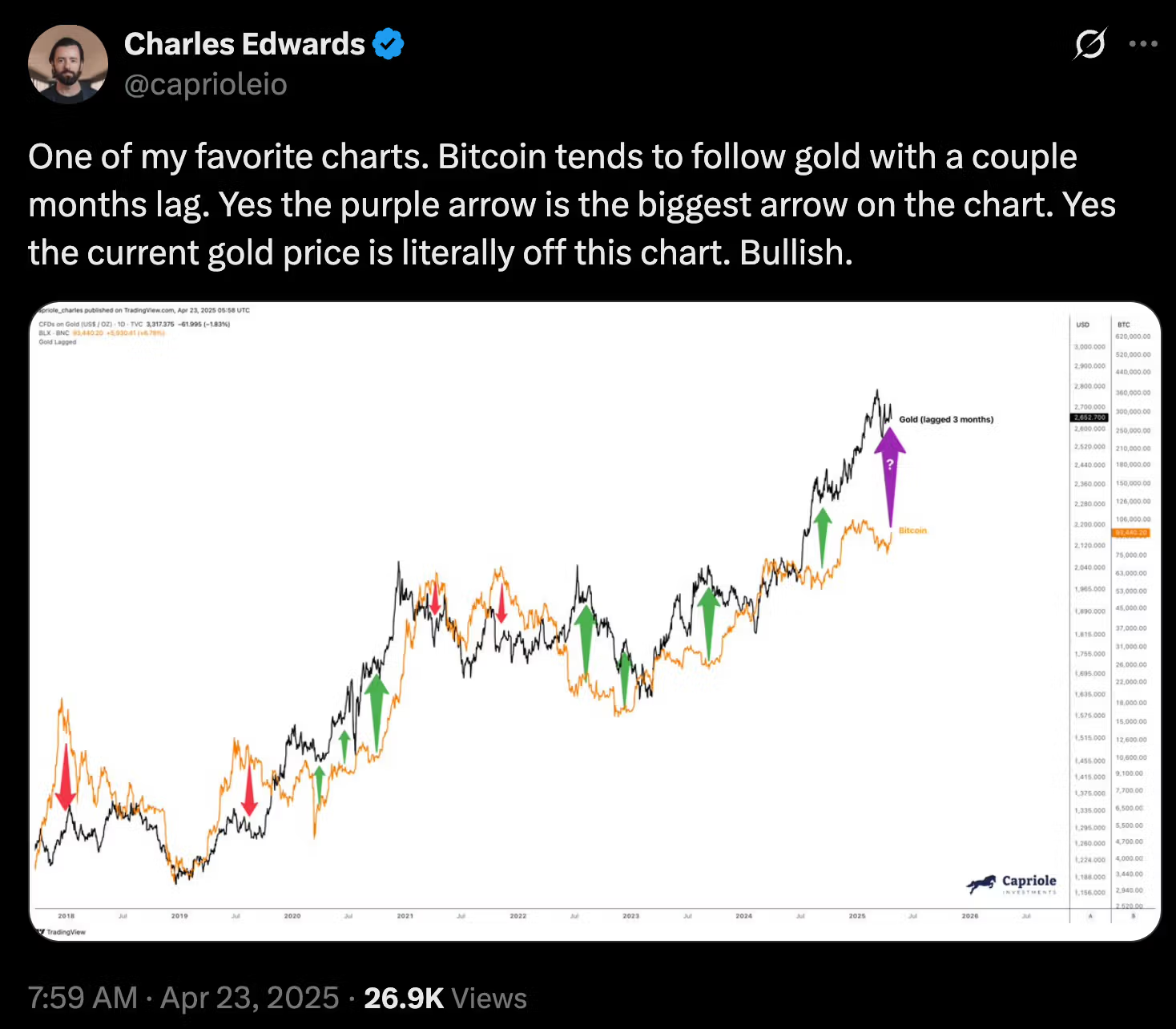

- Charles Edwards of Capriole Investments highlighted Bitcoin's historical tendency to follow gold’s price movements with a delay.