1 0

Bitcoin Falls 1% as Goldman Sachs Recommends Yen as Hedge Against Risks

The Bitcoin-Japanese yen (BTC/JPY) pair faced resistance at a key trendline, dropping 1% on bitFlyer. Goldman Sachs cited the yen as the preferred hedge against rising U.S. tariff and recession risks.

- BTC's price in USD also declined.

- Asian equity indices and U.S. futures showed little movement ahead of President Trump's new tariffs.

- Investment banks like JPMorgan and Goldman Sachs anticipate increased chances of a U.S. recession.

- Goldman Sachs emphasized the yen as the best hedge against U.S. economic risks.

- Kamakshya Trivedi from Goldman noted the yen's effectiveness during U.S. labor market weaknesses.

- Historically, BTC has correlated with technology stocks; risk aversion may impact the crypto market.

- The yen's strength could lead to unwinding of risk-on trades, affecting both stocks and BTC.

- Goldman forecasts the yen to strengthen to low 140s against the USD.

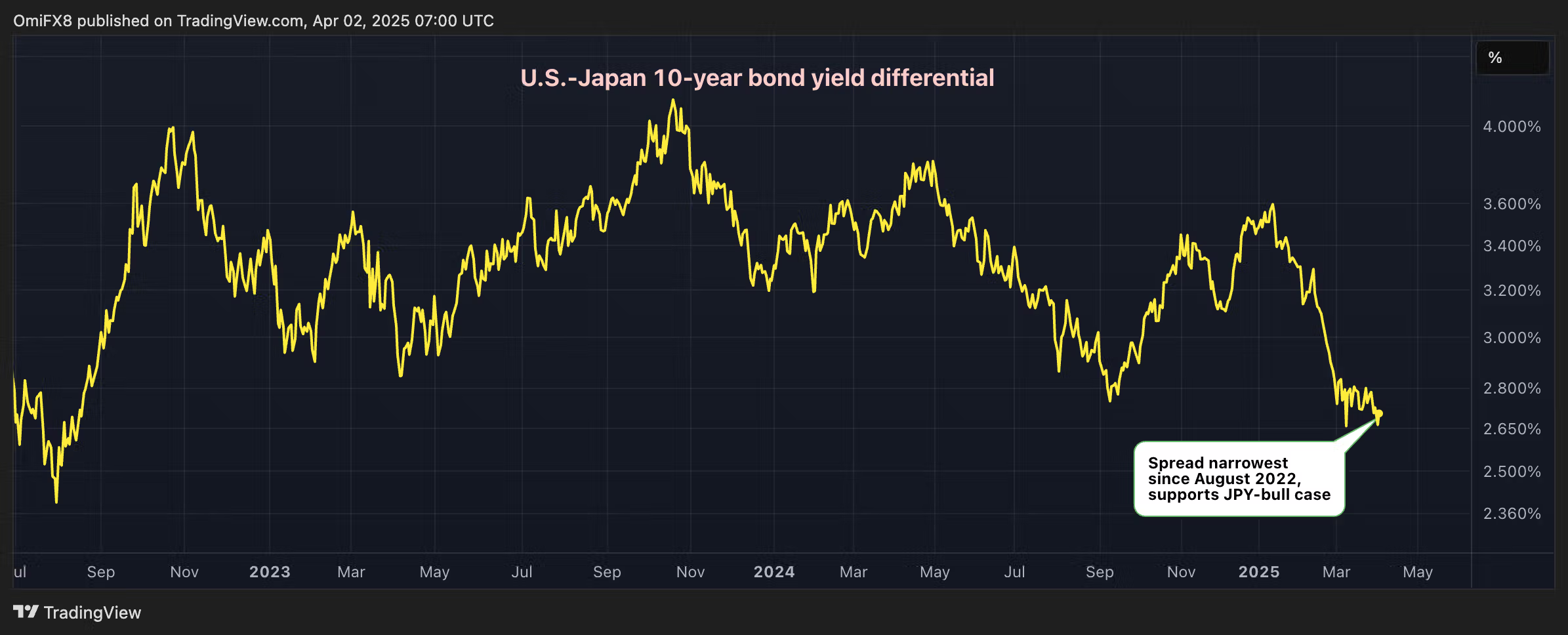

- The current USD/JPY exchange rate is 149.77, influenced by bond yield differentials.