4 0

Bitcoin Falls 3.4% to $113,240 Amid Inflation Concerns

On August 22, 2025, Bitcoin traded at approximately $113,240, down 3.4% from previous highs. The price fell from $120,050 to around $112,990, a decline of about 6% since last Friday.

Market Reaction and Analyst Insights

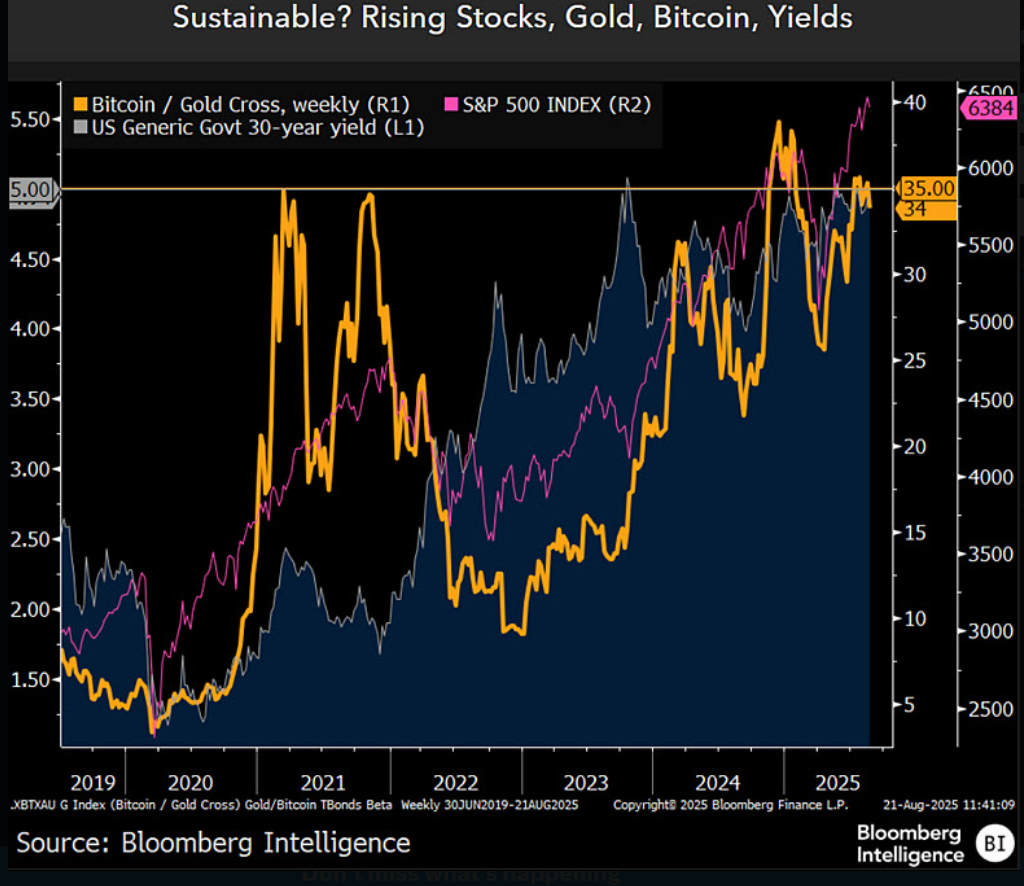

- Mike McGlone from Bloomberg Intelligence noted that the concurrent rise in equities, Treasury yields, gold, and Bitcoin could lead to inflationary pressures.

- He suggested that continued gains in risk assets might prompt the Federal Reserve to adopt tighter policies, countering calls for easing from President Trump.

- The market saw profit-taking after recent spikes, with traders adjusting positions ahead of upcoming Fed commentary at Jackson Hole.

- The recent volatility is within historical norms but significant for major holders and quick-moving funds.

Support Levels and Price Targets

- Key support levels around $112,000 are being monitored.

- Analysts are divided on future Bitcoin prices; some predict a rise to $200,000 if institutional demand remains strong.

- Others suggest a more conservative peak between $140,000 and $150,000 in the near term.

- McGlone cautions that downside risks exist if the Fed tightens monetary policy.