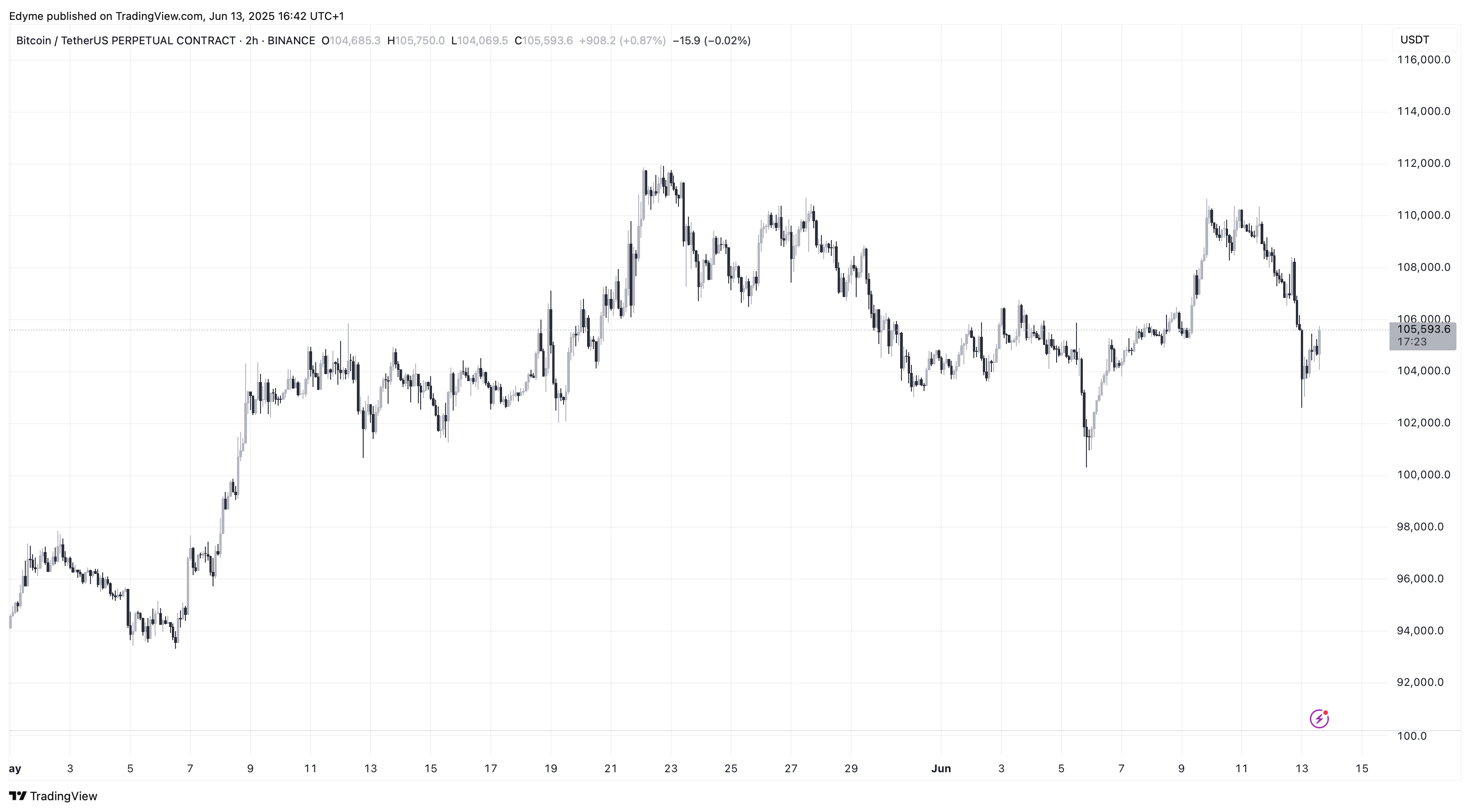

Bitcoin Falls Below $105K as Binance Net Taker Volume Drops to -$197M

Bitcoin's price has dropped to just above $104,000, marking a 2.1% decline in the last 24 hours. This indicates a potential shift in short-term market momentum as traders exit positions.

Key points include:

- The broader cryptocurrency market is experiencing similar pullbacks.

- External factors, particularly geopolitical tensions, are influencing trading behavior.

- A military engagement between Israel and Iran on June 13 has increased sell pressure across high-risk assets.

- Binance's Net Taker Volume shows increased sell-side dominance, suggesting ongoing short-term volatility.

Binance Net Taker Volume Hits Multi-Week Low Amid Bitcoin Panic Selling

Bitcoin’s Net Taker Volume on Binance reached -$197 million, its most negative level since June 6. This metric reflects intense selling urgency among traders, with the seven-hour moving average remaining negative since June 12.

Historically, extreme net taker volumes indicate panic selling by retail and overleveraged traders, often leading to local price bottoms. A similar event on June 6 preceded a 4% rebound in Bitcoin's price.

Geopolitical Shock Triggers Liquidation Cascade, May Signal Local Bottom

The escalation between Israel and Iran has triggered significant liquidation activity among long-leveraged positions. This correlation suggests traders are responding to broader market uncertainty.

Despite current volatility, conditions may be bullish for the medium term. Heavy selling typically flushes out weaker hands, allowing long-term holders or institutional investors to accumulate at lower prices. The setup resembles previous recovery phases characterized by contrarian buying and reduced selling pressure.