Bitcoin Fear & Greed Index Reaches Extreme Greed at 77

Data indicates that Bitcoin investor sentiment has reached extreme greed following the asset's surge to a new all-time high (ATH).

Bitcoin Fear & Greed Index Indicates 'Extreme Greed'

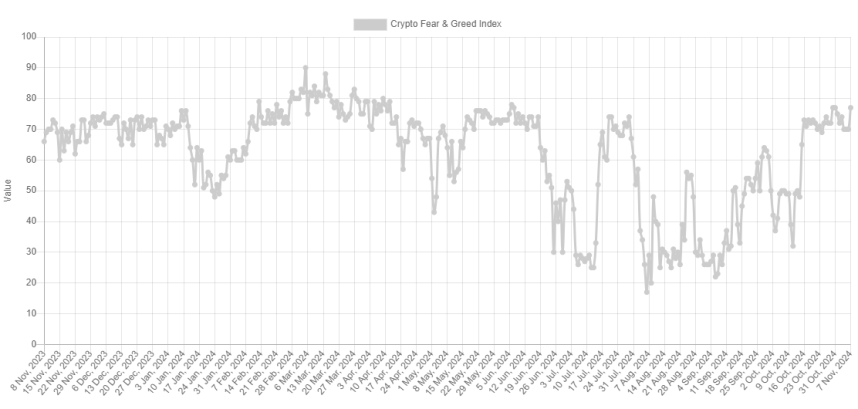

The "Fear & Greed Index" is an indicator developed by Alternative that measures average sentiment among traders in the Bitcoin and broader cryptocurrency markets.

This index scores sentiment on a scale from zero to one hundred, utilizing data from five factors: volatility, trading volume, market cap dominance, social media sentiment, and Google Trends.

A score above 53 indicates a sentiment of greed, while a value below 47 suggests fear. Scores between these thresholds reflect a neutral sentiment.

Additionally, there are two special zones: extreme greed occurs above 75, and extreme fear occurs below 25.

Currently, the Bitcoin Fear & Greed Index registers:

The index shows a value of 77, indicating a sentiment of extreme greed, a shift from yesterday’s normal greed region.

Below is a chart showing the index's fluctuations over the past year:

Historically, extreme sentiments have been significant for Bitcoin, as major price tops and bottoms often occur in these zones.

The relationship between sentiment and price is typically inverse; extreme greed correlates with price tops, while extreme fear corresponds with price bottoms.

The graph illustrates that the Fear & Greed Index peaked in extreme greed territory when Bitcoin reached its peak in the first quarter of this year.

With renewed hype surrounding cryptocurrency following the recent ATH break, it is possible another top could form for BTC.

Major tops generally occur at particularly high index levels. For instance, a previous top occurred with an index value of 88, suggesting that sentiment may still have room to increase before encountering a major barrier.

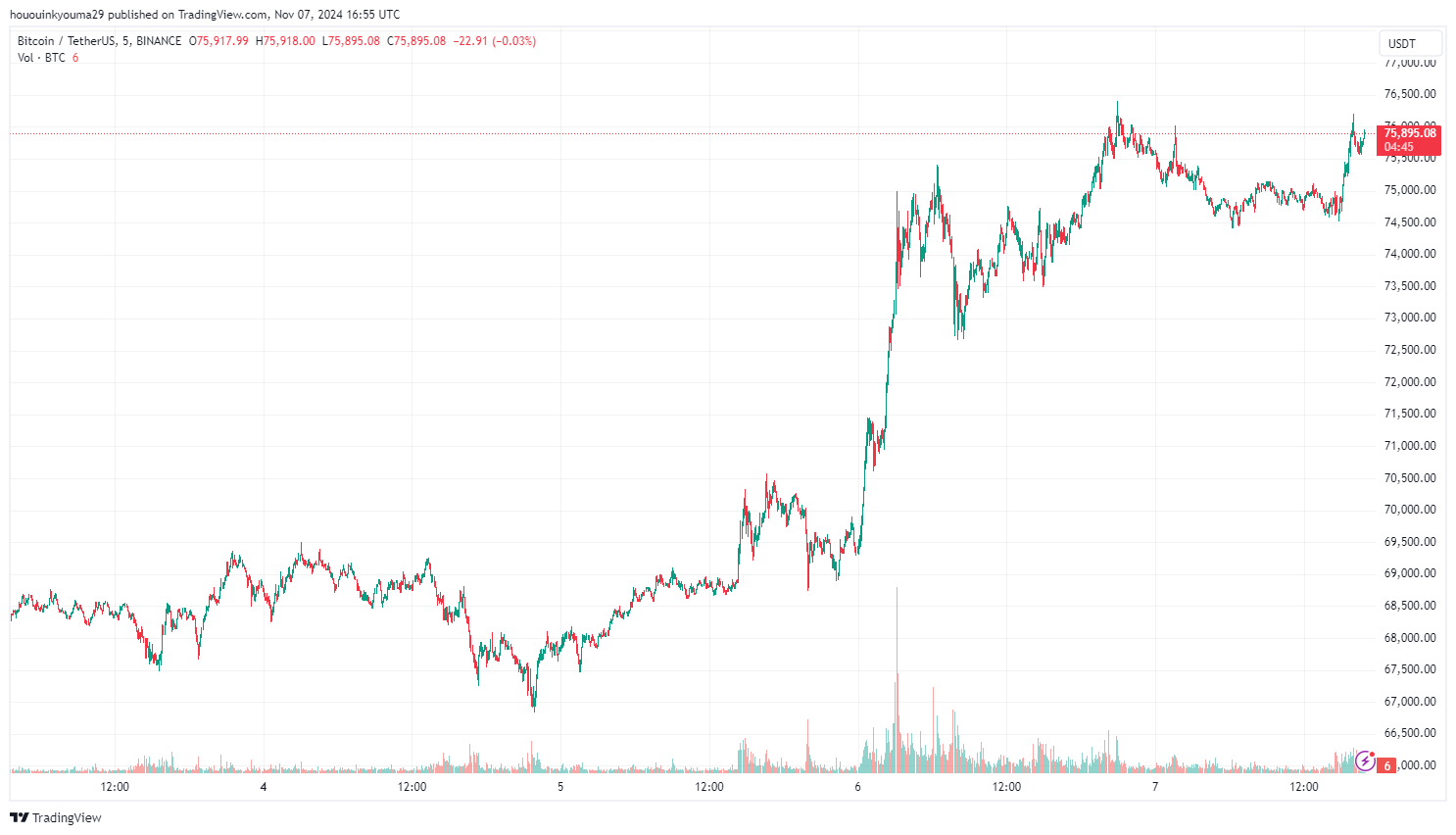

BTC Price

Currently, Bitcoin is priced around $75,900, reflecting an 8% increase over the past week.