Bitcoin Fear & Greed Index Indicates Greed Sentiment at 75

On-chain data indicates that the Bitcoin Fear & Greed Index has decreased from extreme greed, which may positively impact BTC's price.

Bitcoin Fear & Greed Index Is Indicating 'Greed'

The Fear & Greed Index, developed by Alternative, measures investor sentiment in the Bitcoin and cryptocurrency markets. It operates on a scale from zero to one hundred: values above 53 indicate greed, while those below 47 reflect fear. A neutral mentality exists between these thresholds.

In addition to standard sentiments, the index also identifies extreme fear (below 25) and extreme greed (above 75).

Currently, the Bitcoin Fear & Greed Index shows:

The index is at 75, indicating a strong sentiment of greed, approaching extreme greed levels. Historically, such sentiments are significant for Bitcoin as they often coincide with major price reversals.

This inverse relationship suggests that market bottoms occur during high fear, while tops happen amid extreme greed. Traders utilizing contrarian investing strategies buy during extreme fear and sell during extreme greed, reflecting Warren Buffet's principle: "be fearful when others are greedy, and greedy when others are fearful."

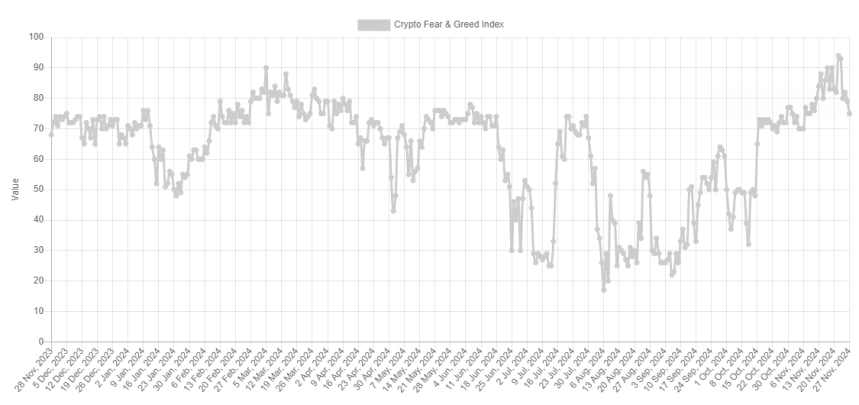

Although the current index value is high, it was even higher recently, as shown in the chart below:

During a recent rally, the index peaked at 94 alongside Bitcoin's price exceeding $99,000. Following this peak, Bitcoin experienced a notable price correction.

A cooldown in sentiment into the fear region could signal a potential reversal, but in strong bull runs, a shift to the neutral or normal greed zone might be sufficient to sustain momentum.

With the Fear & Greed Index indicating greed once more, it remains uncertain if Bitcoin will rebound.

BTC Price

As of the latest data, Bitcoin is trading at approximately $93,800, reflecting an increase of over 1% in the last 24 hours.