Bitcoin Historically Sees Flat June Followed by Positive July Returns

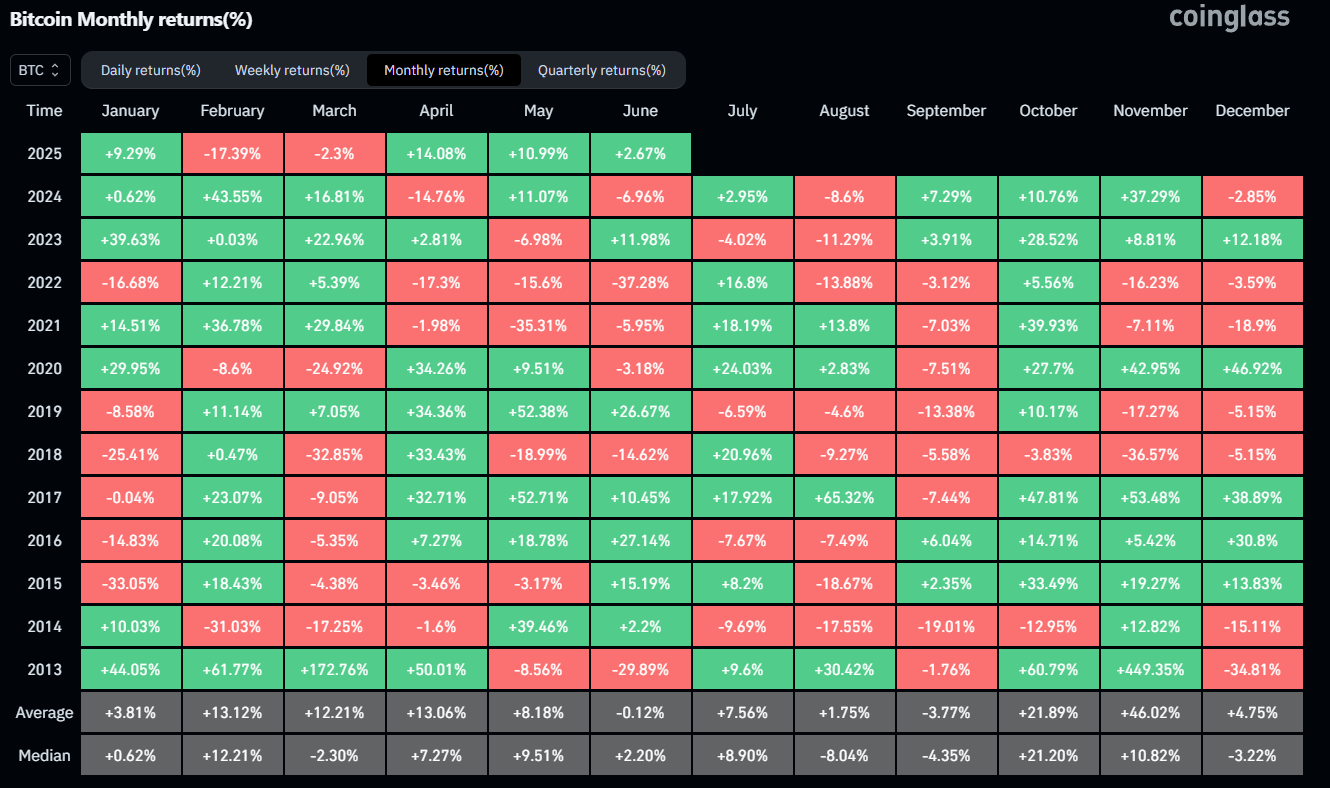

Market tactician Daan Crypto Trades highlighted Bitcoin's trend of slow performance in June, followed by potential rewards or punishments for traders in the subsequent quarter. June's average return is virtually zero (-0.12%), while July averages a +7.56% gain, with historical patterns indicating that July has been positive in eight of the last twelve years.

Key Insights on Bitcoin's Seasonal Performance

- June shows low volatility and flat price movements.

- July historically yields higher returns with an average of +7.56% and a median of +8.90%.

- August and September tend to be less favorable, averaging +1.75% and -3.77%, respectively.

- Significant past trends include 2017's +65.32% surge in August followed by a -7.44% decline in September.

Daan noted that August and September often see major sell-offs but may present buying opportunities leading up to year-end rallies. Current market conditions show Bitcoin testing long-term resistance levels around $107,344.

The upcoming months may lead to increased volatility due to macroeconomic factors, with October historically being the best month, showing a mean return of +21.89%. Daan also remarked on the TOTAL Altcoin Market Cap, which requires breaking local highs above ~$950 billion for further upward momentum.