3 0

Bitcoin Maintains Four-Year Cycle Amid Signs of Demand Fatigue

Bitcoin may still adhere to its four-year halving cycle, according to on-chain data from Glassnode, despite discussions about institutional inflows disrupting this pattern. Key points include:

- Profit-taking among long-term holders is at levels akin to previous market euphorias.

- Spot Bitcoin ETFs experienced approximately $970 million in outflows over the last four trading sessions.

- Bitcoin is trading around $113,450, down 8% from its all-time high of $124,100 achieved on August 14.

- 24-hour trading volume has decreased by over 10%, indicating declining investor interest.

- Analysts suggest the cycle peak might not have been reached yet, with potential for an altcoin rally.

- Previous cycles indicate Bitcoin's peak occurred two to three months after the current point, suggesting a possible top as early as October.

More BTC Price Upside Ahead?

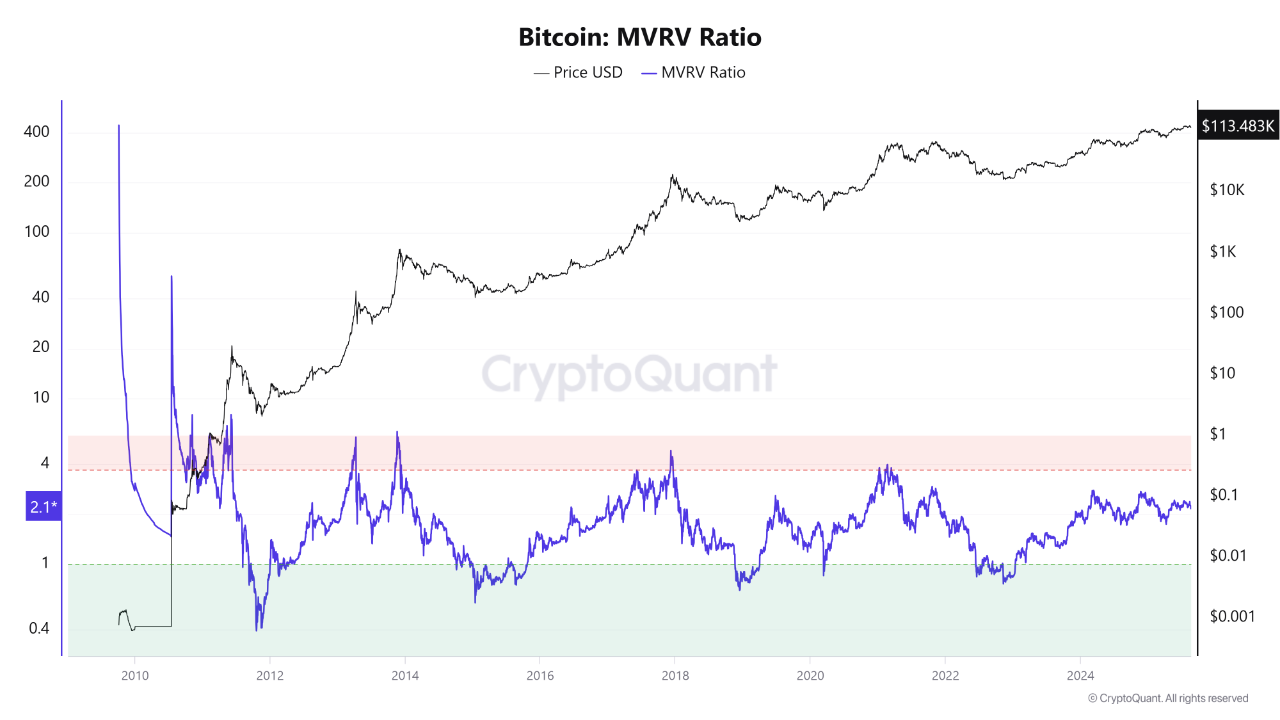

A CryptoQuant analysis indicates that historically, bull markets peak when the Market Value to Realized Value (MVRV) ratio reaches 3.5 to 4. Currently, the MVRV ratio is at 2.1, suggesting Bitcoin is neither undervalued nor overheated, leaving room for further upside with potential targets between $140,000 and $180,000. However, short-term corrections may occur as the MVRV rises above 2.

BTC MVRV Ratio, which shows Bitcoin’s current MVRV level and historical peaks during previous bull market cycles. | Source: CryptoQuant