8 1

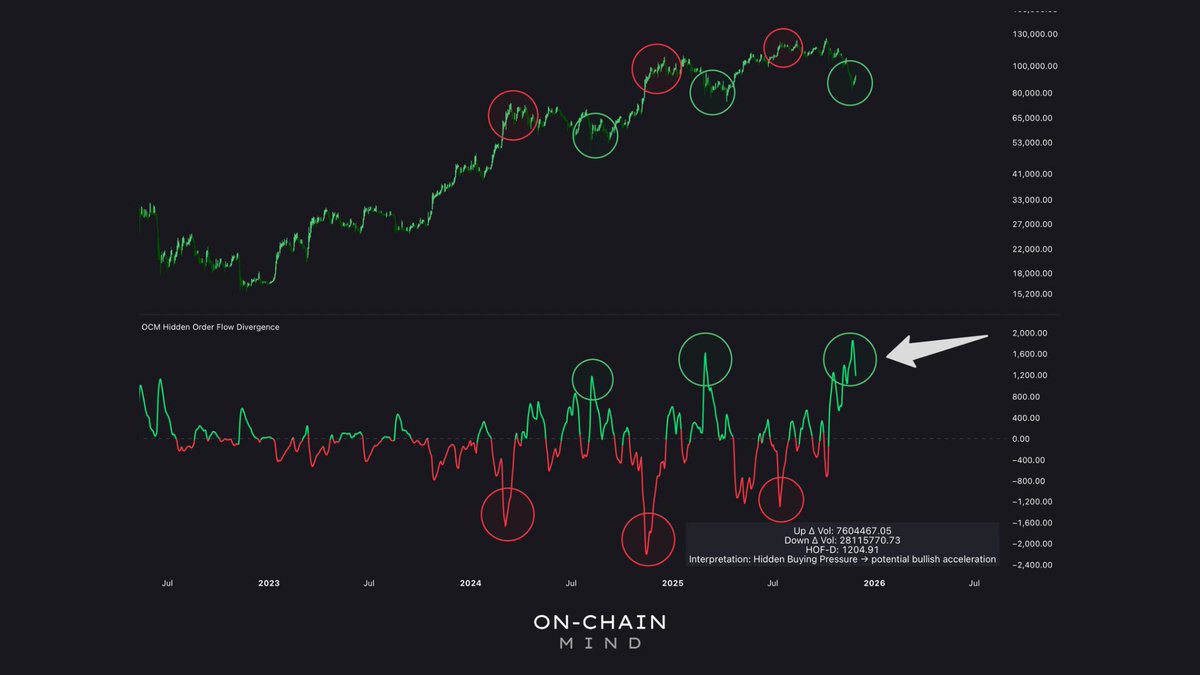

Bitcoin Faces Fragile Trend with Largest Hidden Buying Spike Detected

Bitcoin Market Update

- Bitcoin is struggling to regain the $90,000 level after a sharp decline, leading to concerns about a deeper downtrend.

- Market sentiment is weak, with increased selling pressure in both spot and derivatives markets.

- Liquidity is thinning, causing heightened volatility where minor inflows can lead to significant price reactions.

- The recent rejection below $90K raises questions about Bitcoin entering a more prolonged corrective phase.

- On-chain data reveals a significant hidden-buying spike, suggesting large players may be accumulating Bitcoin despite the broader market's focus on the decline.

- This hidden buying could potentially counteract the current sell pressure, influencing Bitcoin's next move.

Hidden Buying and Market Sentiment

- The persistent hidden-buying signal indicates potential future upside despite current macro fears.

- External narratives, such as a renewed China Bitcoin ban and Tether FUD, have contributed to bearish sentiment.

- Sophisticated investors may be taking an opposite stance from retail traders reacting to alarming headlines.

Bitcoin's Technical Analysis

- Bitcoin remains under corrective pressure after a drop from the $110,000 region, failing to reclaim major support levels.

- The price is below the 50 SMA and 100 SMA, which are trending downward, indicating a weakened medium-term trend.

- BTC's attempt to rebound has been modest, forming lower highs consistent with a bearish continuation.

- Volume spikes during sell-offs emphasize seller dominance, with muted buying activity.

- Bitcoin needs to close above $95,000–$98,000 to reduce downside risks and stabilize the trend.