Bitcoin Funding Rates Increase by Over 10% on Major Exchanges

The price of Bitcoin has increased this week, reaching successive all-time highs. A key question among investors is when Bitcoin will exceed the $100,000 mark.

Will The Rising Bullish Sentiment Sustain The Rally?

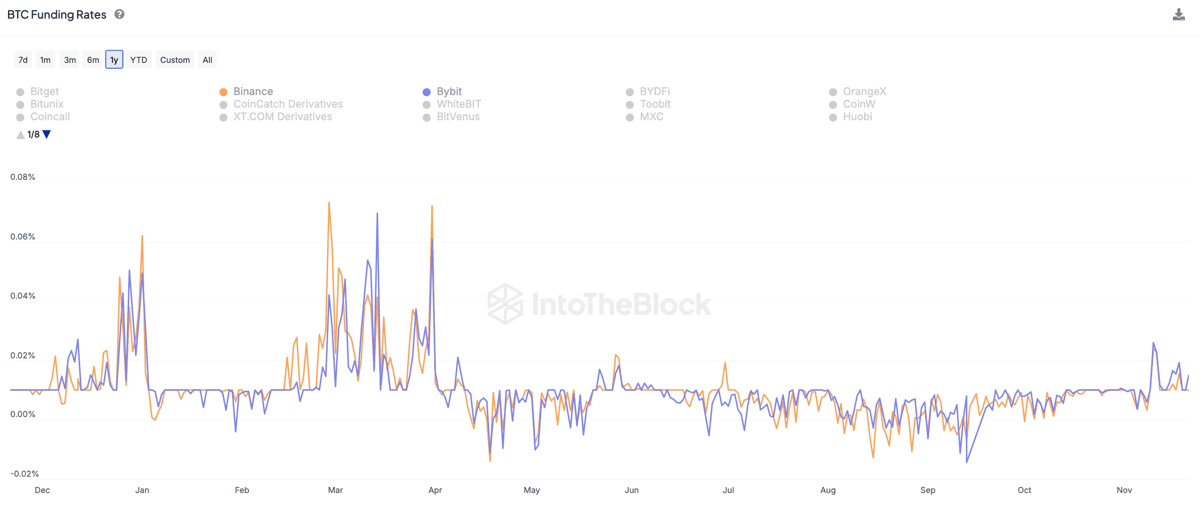

Market intelligence platform IntoTheBlock reports a notable increase in Bitcoin funding rates. The funding rate tracks fees exchanged between traders in the derivatives market. A high or positive funding rate indicates that long traders are paying short traders, reflecting strong bullish sentiment. Conversely, a negative funding rate suggests bearish sentiment.

IntoTheBlock data shows that Bitcoin funding fees for perpetual swaps have increased by over 10%, with rises up to 20% on major trading platforms. However, continuous growth in funding rates may indicate speculative overheating, leading to potential market corrections. Analysts suggest that one catalyst for the bullish sentiment could be the US government's evolving stance on crypto under Donald Trump's administration, with expectations of "strategic Bitcoin reserves." Currently, Bitcoin is valued at approximately $98,400, reflecting a 1% increase in the past 24 hours.

Bitcoin Perpetual Futures Market Remains Restrained — What It Means

Glassnode recently stated that the Bitcoin perpetual futures market “remains restrained,” indicating cautious trading behavior despite recent price increases. Funding rates are slightly above 0.01%, lower than the March 2024 level of around 0.07%, which was associated with a local price peak. This suggests potential for further growth in Bitcoin's value.