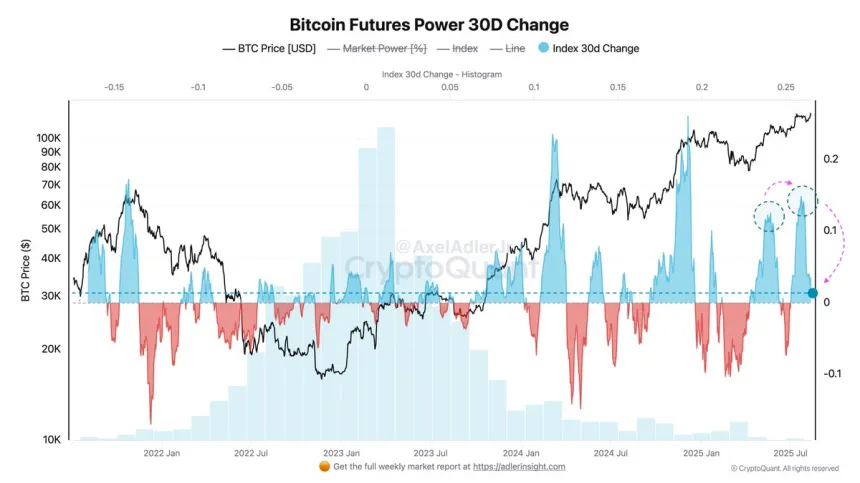

Bitcoin Futures Power Index Reaches Neutral Zone Following Months of Bullish Data

Bitcoin is testing the $120,000 resistance following significant volatility and strong altcoin performance. Ethereum has surged over 230% since April, attracting institutional interest.

The Bitcoin Futures Power index fell to zero in August, indicating reduced momentum in the futures market. Analyst Axel Adler noted that this shift could signal a potential cooldown for Bitcoin if the index moves into negative territory.

The overall market remains active due to increased trading activity. However, analysts predict a short-term cooldown for Bitcoin as futures data shows lack of bullish signals. Ethereum’s growth has diversified market dynamics, suggesting continued strength in altcoins regardless of Bitcoin's performance.

Bitcoin Price Analysis

Bitcoin (BTC) trades at $119,967, up 0.34%, approaching critical resistance at $120,000. The all-time high stands at $123,217, a key hurdle for bulls.

BTC has recovered from lows near $114,000, trading above key moving averages. The current consolidation below resistance suggests a possible breakout if buying momentum increases. A close above $123,217 may trigger further upward movement, while failure to break could lead to a retracement towards the $117K support area.