3 0

Bitcoin Futures Sentiment Weakens Amidslowing Price Recovery

Bitcoin's price is experiencing a slight pullback after rising close to $86,000, currently hovering above $84,000. This follows a 10% increase in the past week, recovering from recent corrections linked to macroeconomic factors.

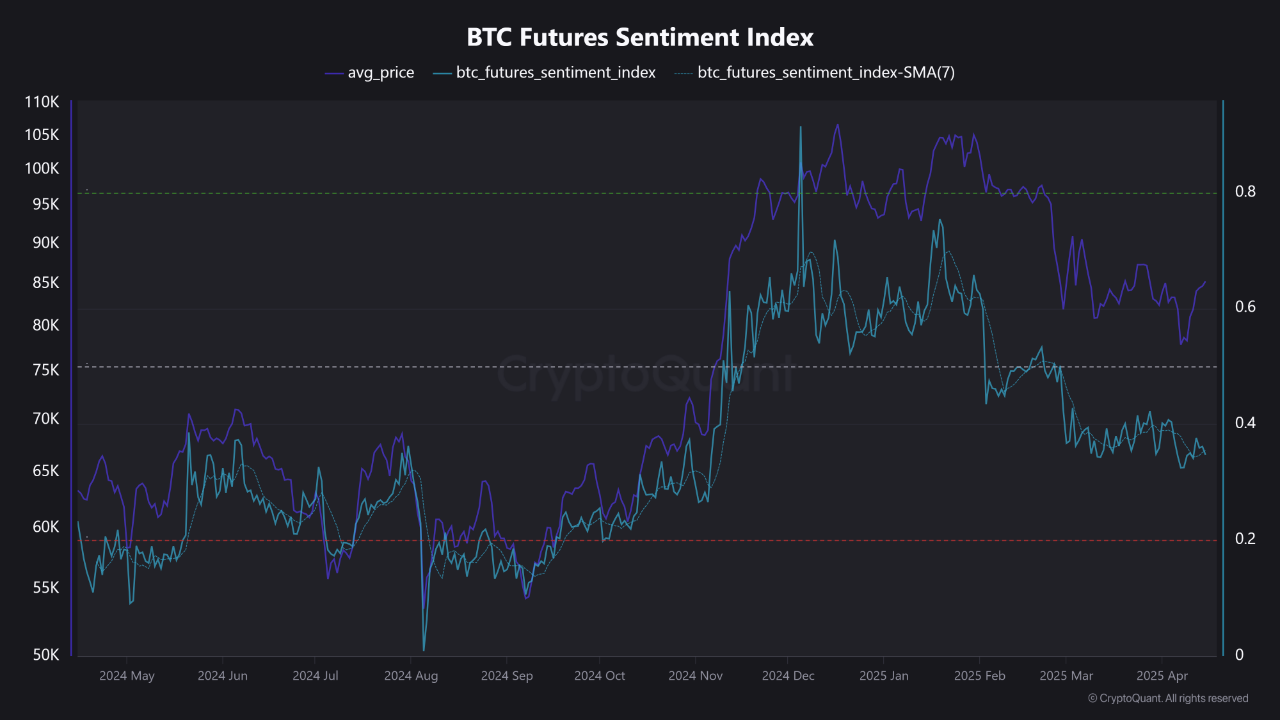

- Futures sentiment has not matched the recent price surge, indicating caution among derivative traders.

- Sentiment index peaked early and is now declining, trending near the support zone at 0.4, suggesting increased bearish sentiment.

- Resistance for the sentiment index is around 0.8, with support near 0.2, reflecting ongoing profit-taking and uncertainty in the market.

- Current trading range between $70K and $80K indicates possible accumulation rather than strong bullish conviction.

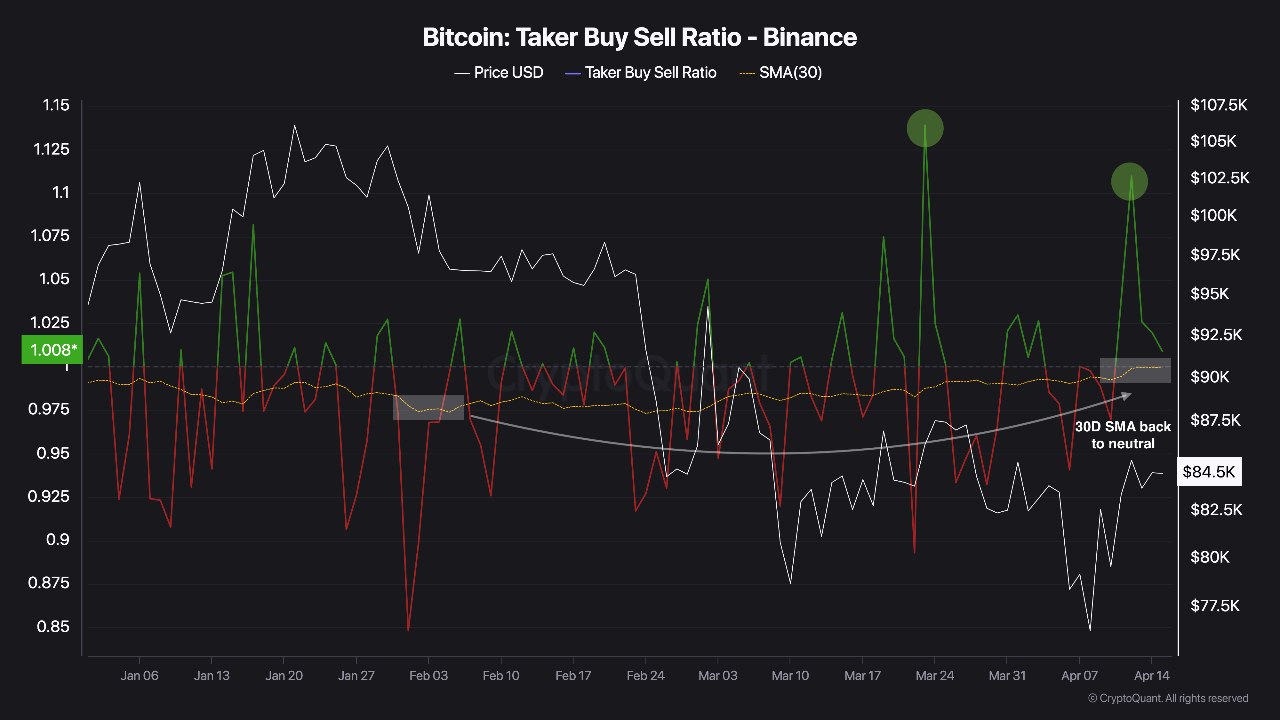

In contrast, Binance derivatives show signs of renewed optimism. The taker buy/sell ratio has shifted back to neutral territory, indicating increasing buyer activity.

- The ratio trending above 1 suggests buyer dominance, with long traders becoming more active.

- This shift may signal short-term momentum returning in favor of bulls, particularly on key trading platforms like Binance.