6 0

Bitcoin Gains 1.6% to $107,428 Amid Positive On-Chain Metrics

Bitcoin has gained 1.6% in the last 24 hours, trading at $107,428 after dipping toward $100,000 last week due to market volatility and profit-taking. The price remains about 4.2% below its all-time high of $111,000 from last month, but shows a weekly increase of 3.3%, indicating a gradual recovery in buyer confidence.

Bitcoin On-Chain Metrics Indicate Accumulation

Analysis by CryptoQuant contributor Amr Taha highlights several on-chain metrics suggesting potential for continued price rally:

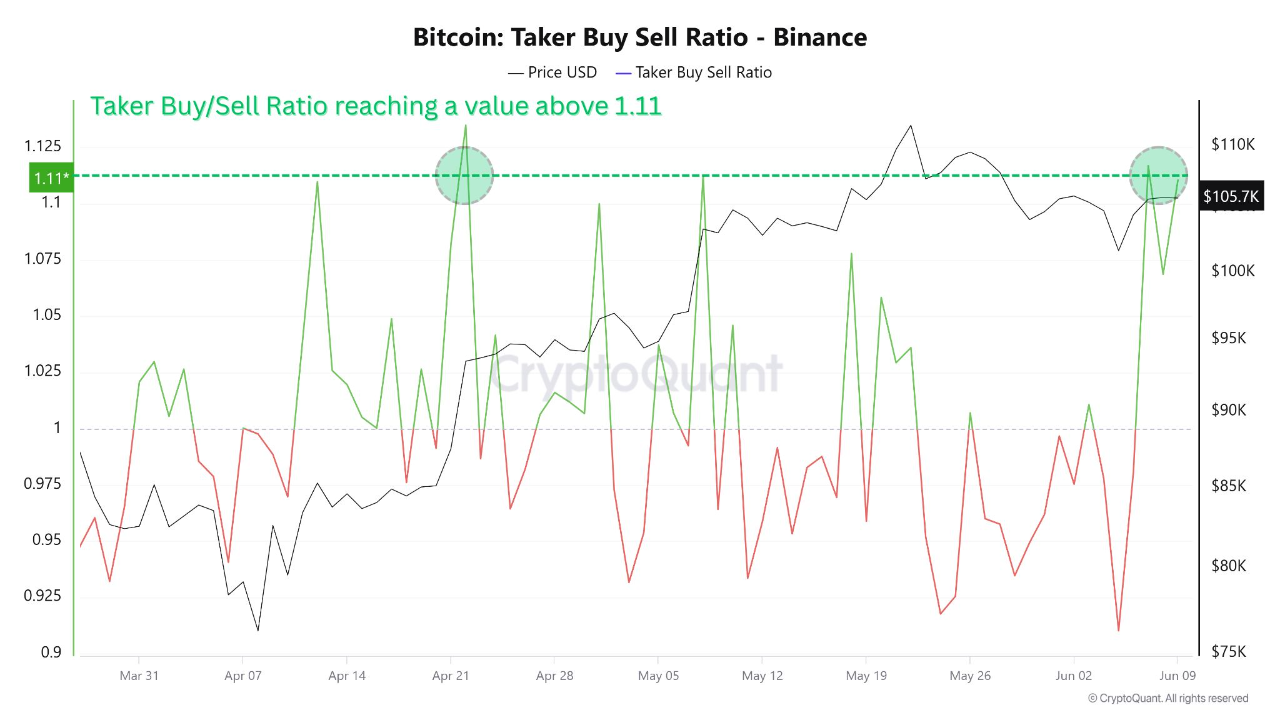

- Binance Taker Buy/Sell Ratio at 1.1 indicates stronger buyer conviction.

- Buy/Sell Pressure Delta nearing its historical peak at 0.02 suggests room for further accumulation.

- Recent breakout behavior above the 1D–1W UTXO band implies many new holders are in profit and choosing to hold.

Long-Term Holder Confidence and Stablecoin Inflows

Key findings include:

- Long-Term Holder (LTH) Realized Cap exceeds $56 billion, indicating strong hands holding Bitcoin for over 155 days.

- Over $550 million in stablecoin inflows into Binance suggest readiness for direct asset purchases.

These indicators may signal increased buying pressure and potential volatility, supporting Bitcoin’s short-term price activity through ongoing accumulation and institutional interest.