Bitcoin Shows 5% Gain in October Amid Economic Uncertainty

PrimeXBT: Cryptocurrency Trading Outlook for the Remainder of the Year

By Matthew Hayward, Senior Market Analyst at PrimeXBT

Current Market Performance

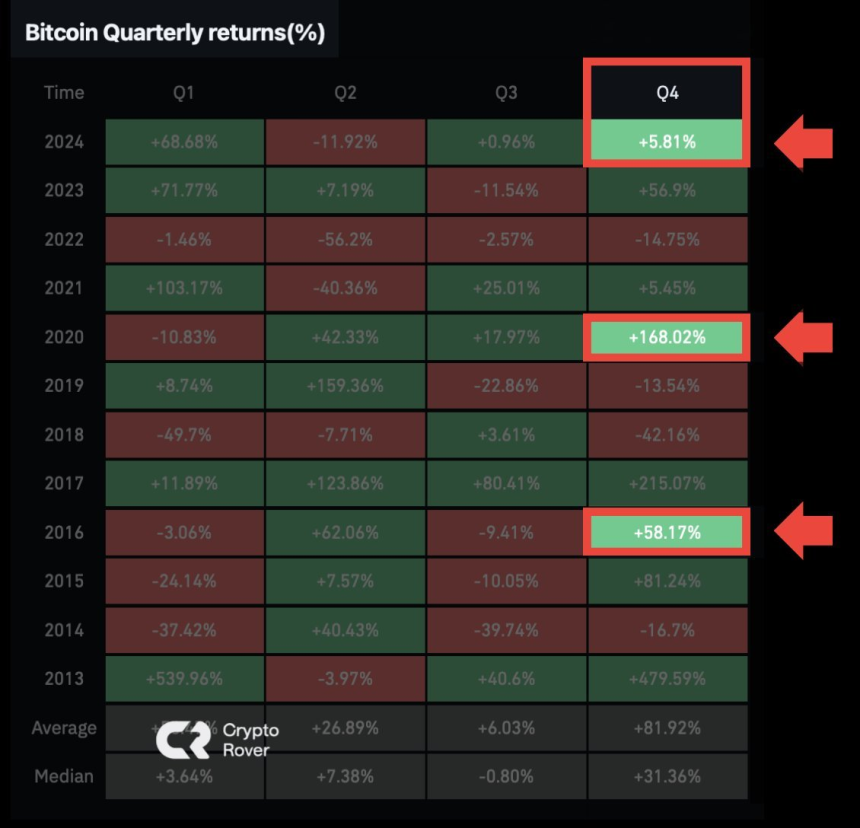

Historically, the fourth quarter and October are strong months for cryptocurrencies, especially Bitcoin. This year, Bitcoin's performance has been modest, showing an increase of over 5% this month. Factors contributing to this underwhelming performance include economic announcements and market shifts.

Source: Crypto Rover

Impact of Political Events

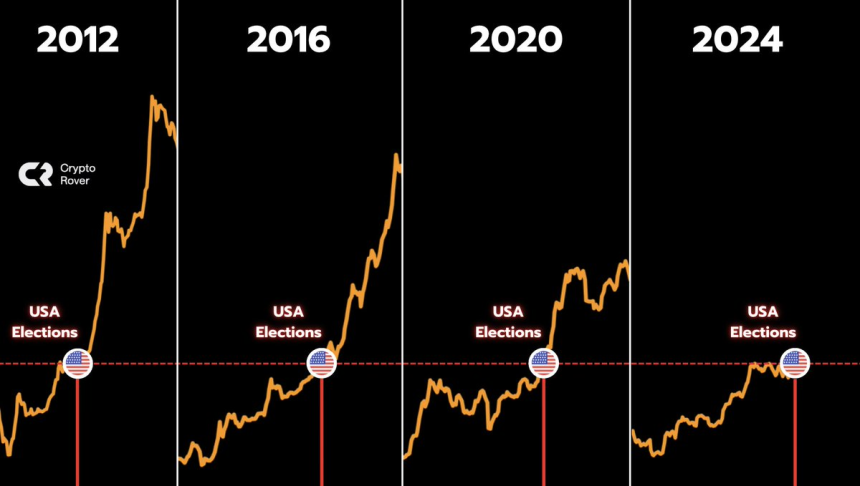

Political factors, particularly the upcoming U.S. elections, are influencing market sentiment. Trump's rising popularity may lead to positive momentum in cryptocurrency markets, as he has expressed support for cryptocurrency adoption. Historical data shows a correlation between U.S. election cycles and Bitcoin price increases.

Source: Crypto Rover

Macroeconomic Landscape

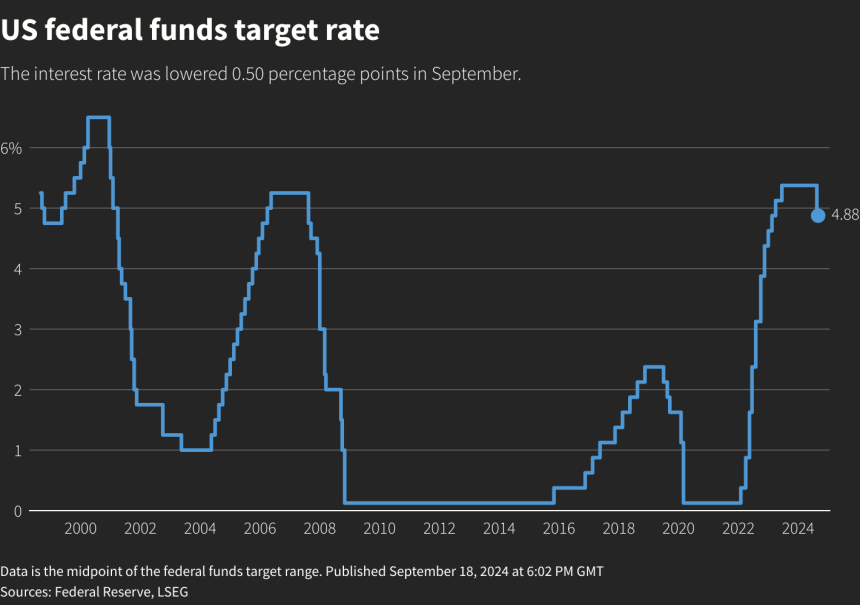

The Federal Reserve's recent 0.5% interest rate cut marks a significant shift from previous stability. This decision harkens back to the last major rate cut before the 2008 financial crisis. Following this, Non-Farm Payroll data exceeded expectations, raising questions about potential inflation and its implications for the economy.

Source: Reuters

Source: Reuters

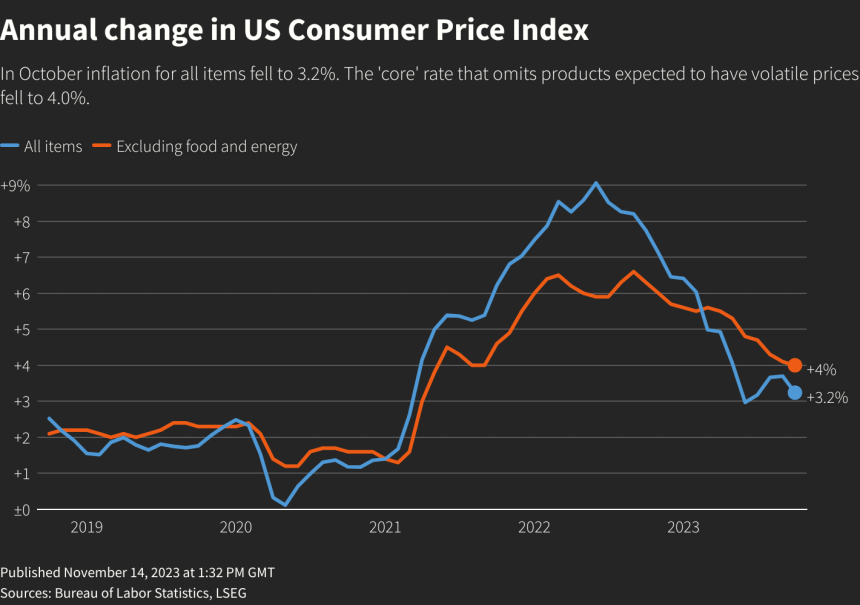

Inflation Concerns

With the Fed's interest rate reduction and stronger job reports, inflation concerns have intensified. CPI figures recently showed a slight rise to 2.4%, close to the prior month's 2.5%. Continued inflation alongside stagnant GDP could lead to stagflation risks.

Source: Reuters

Potential Economic Downturn

Bitcoin has historically thrived in post-2008 economic conditions. The current climate raises questions about how potential "Black Swan" events might affect Bitcoin's price trends and established cycle theories.

Source: Seekingalpha

Market Reactions to Economic Developments

As cryptocurrency adoption grows, traditional indicators increasingly influence trading strategies. Prior to the interest rate cut, Bitcoin's price rose due to positive sentiment surrounding risk assets. However, unfavorable CPI data led to negative market reactions, indicating that traders are cautious about rising inflation.

Conclusion

Economic uncertainties present both challenges and opportunities for traders. Understanding the interplay between political events and macroeconomic indicators is crucial for navigating the evolving cryptocurrency landscape.

Disclaimer: The content provided here is for informational purposes only and does not constitute personal investment advice. Past performance is not indicative of future results. Financial products offered by the Company carry high risks, and virtual assets are volatile. Consider your understanding of leveraged products and your ability to bear the associated risks before engaging. PrimeXBT does not accept clients from Restricted Jurisdictions as indicated on its website.