Bitcoin Could Emerge as Global Monetary Standard, Says VanEck Research Head

Matthew Sigel, Head of Digital Assets Research at VanEck, believes Bitcoin could become a global monetary standard akin to gold. This perspective is gaining attention amid discussions about a US Strategic Bitcoin Reserve.

The Future Of Finance: The Role Of Bitcoin

Key points from Sigel's statements include:

- Bitcoin could significantly impact global finance.

- A proposed US strategic reserve of 1 million BTC may position Bitcoin as a new currency.

- This mirrors historical government practices of accumulating gold for economic strength.

The gold standard once defined reserve assets. Now, Bitcoin presents the opportunity to converge on a ‘Digital Standard’ for money. It could very well echo gold’s role in reshaping global finance.

— matthew sigel, recovering CFA (@matthew_sigel)

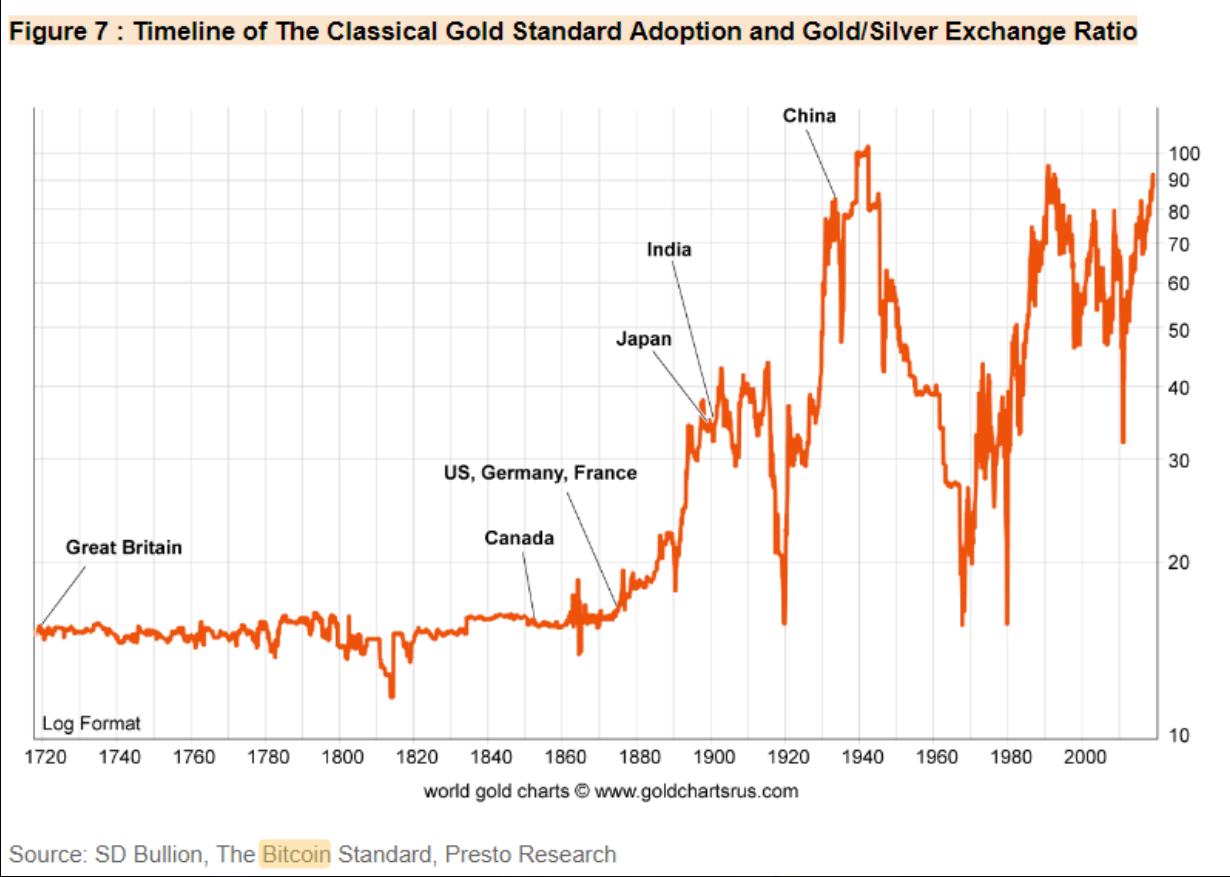

Gold Vs. Bitcoin: Lessons From History

Comparison of Bitcoin and gold highlights:

- Gold is viewed as a safe haven; Bitcoin offers fast, portable transfers.

- Bitcoin's supply is capped at 21 million coins, enhancing its scarcity appeal.

- Recent political changes have led some nations to adopt Bitcoin as legal tender.

Critics caution that Bitcoin's volatility could hinder its adoption as a stable medium of exchange compared to gold's steady purchasing power.

Sigel's commentary indicates growing interest in the potential shifts in financial systems due to Bitcoin's evolution alongside gold.