Bitcoin Golden Multiplier Ratio Indicates Price Could Reach $122,000

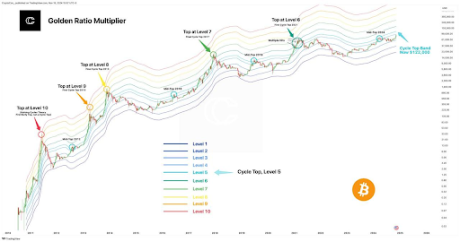

Crypto analyst CryptoCon discussed the Bitcoin ‘Golden Multiplier Ratio,’ suggesting a bullish outlook for Bitcoin. He indicated that the price is likely to rise significantly, stating that the market's growth phase has just begun.

Bitcoin Golden Ratio Multiplier Indicates Price Is Going Higher

In a recent post, CryptoCon noted that the Golden Multiplier Ratio suggests Bitcoin's price will increase. He referenced level 5 of this ratio, which serves as both a mid-top and cycle top indicator. Bitcoin reached a previous all-time high of $73,000 at this level in March.

CryptoCon projected that Bitcoin could reach this level again before the current market cycle concludes, with the level 5 target now at $122,000 and continuing to rise. He suggested that the potential for further price increases remains strong.

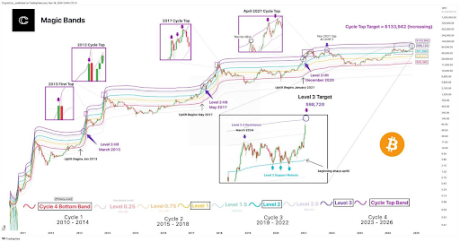

Additionally, CryptoCon utilized the Magic Bands indicator, forecasting that Bitcoin might reach level 3 at $98,720. He stated that these bands are set to expand rapidly as they adjust to trading volumes beyond previous highs.

The cycle top target, according to CryptoCon, has shifted to $134,000, with expectations of Bitcoin gaining $1,000 weekly. He anticipates reaching this cycle top by late 2025, allowing ample time for upward price adjustments.

BTC Primed To Reclaim Local Highs

Analyst CrediBULL Crypto stated that Bitcoin appears ready to approach local highs, provided it does not fall below $87,700. A decisive move above the local high of $93,800 could propel Bitcoin past $100,000, reducing the likelihood of a drop to $72,000 until the next bear market.

If such a move does not occur, CrediBULL Crypto warned that it would indicate a corrective trend, increasing the chances of retesting the range between $70,000 and $72,000, with the possibility of falling below $70,000.

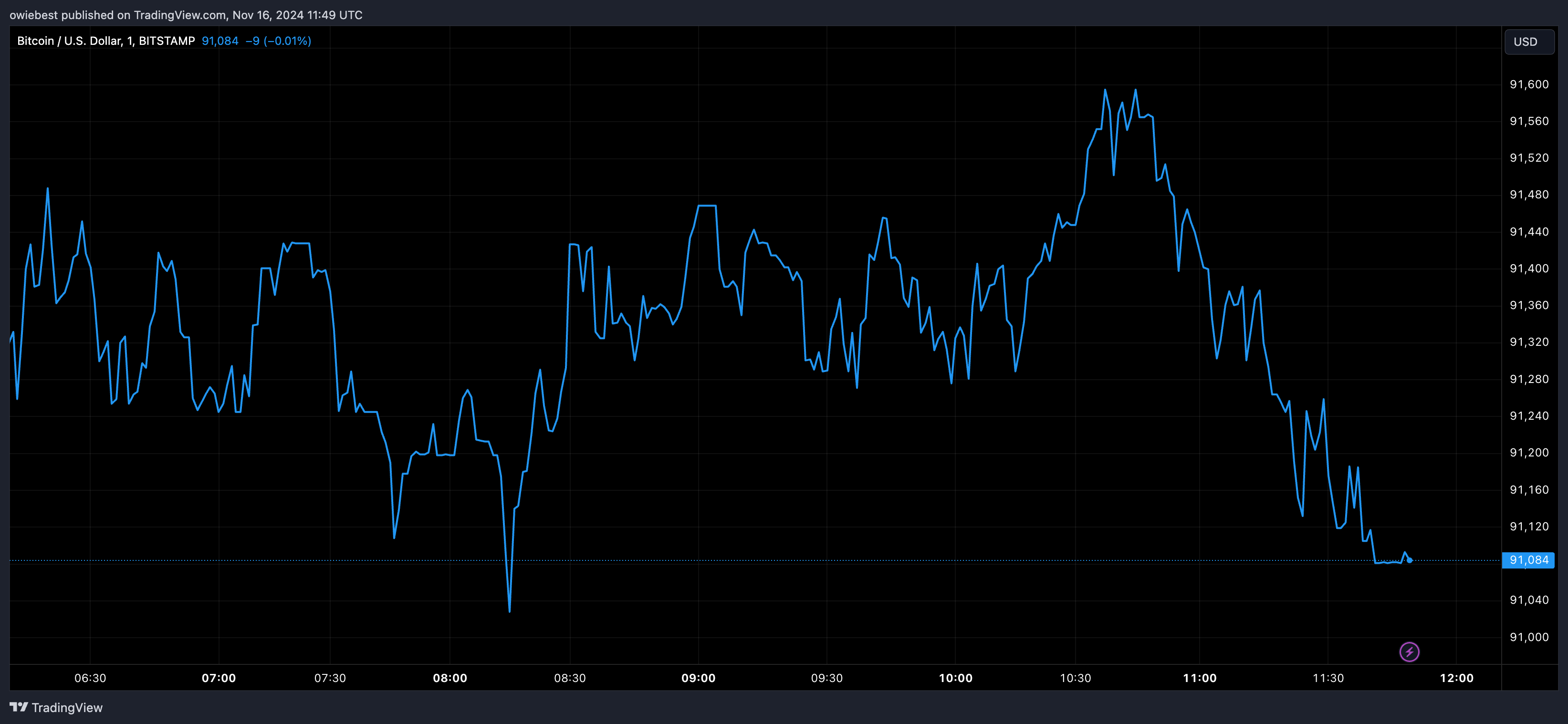

Currently, Bitcoin is trading around $91,200, having risen nearly 4% in the last 24 hours, according to CoinMarketCap.