7 0

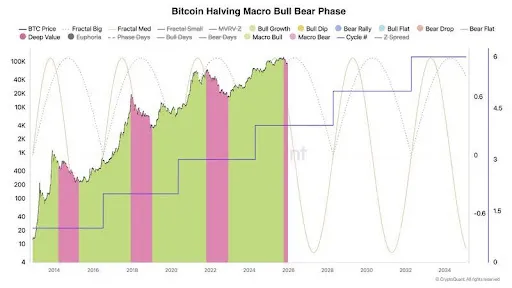

Bitcoin Halving Cycle Evolving Beyond Fixed Four-Year Timelines

The narrative that Bitcoin’s [halving](https://holder.io/coins/btc/) follows a strict four-year cycle is oversimplified. The halving influences supply reduction, but its market impact has expanded due to BTC's maturation as a global asset.

Cycle Narrative Reevaluation

- An analyst notes Bitcoin’s cycle involves phase transitions and liquidity shifts, not just a four-year buying-selling cycle.

- The halving acts as a structural anchor, not a price guarantee. Market tops often arrive later than expected, with extended bear markets.

- Kyle Chassé highlights a significant market divergence where traders ignore the $130 billion liquidity injection by the US Treasury and Fed.

- This liquidity injection leads to delayed asset repricing, not immediate price changes.

Retail Holder Behavior

- Retail holders are reducing their balances at rates not seen since 2018, indicating fear and capitulation.

- Larger holders are absorbing these sales, with market sentiment divided between retail reacting to prices and larger holders focusing on structure and long-term positioning.

- Mega whales and institutional participants are becoming key buyers, while OG whales continue distribution.