Bitcoin Remains in Healthy Growth Phase Amid Moderate Market Optimism

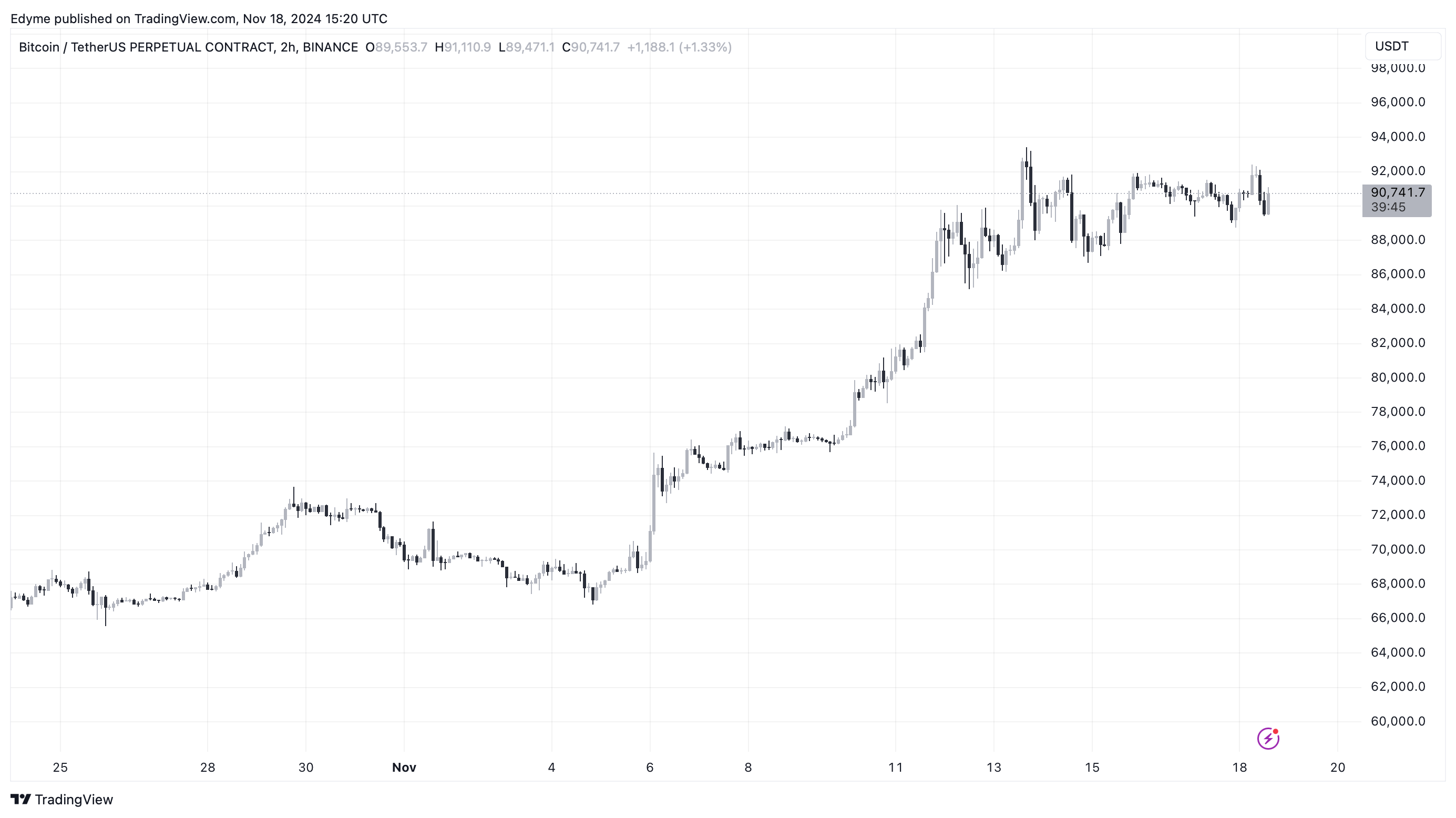

Last week, Bitcoin experienced upward momentum, reaching a peak of $93,477. Since then, BTC has seen a price decrease but remains stable above $90,000, indicating controlled market sentiment.

STH SOPR Metric Analysis

The Short-Term Holders Spent Output Profit Ratio (STH SOPR) metric tracks profitability among short-term Bitcoin holders. Analyst G a a h noted that the STH SOPR indicates moderate optimism in the market. Unlike previous cycles with euphoric spikes, current readings are within a "middle region," suggesting stability and potential for further growth.

The relationship between the SOPR and Bitcoin's 30-day moving average shows that short-term holders are taking profits without creating significant sell pressure, which signals "healthy growth." Historical data indicates that extreme greed often leads to market corrections.

Accumulation typically occurs when the indicator reflects extreme fear, marking key price bottoms. The analyst believes Bitcoin is in a transitional growth phase, with investors adjusting positions as the price trends upward. G a a h stated:

The behavior of the SOPR suggests a phase of healthy growth, with moderate optimism. This intermediate position may reflect a market in transition.

Key Indicators for Bitcoin’s Market Behavior

While the SOPR indicates a balanced market, the analyst recommends monitoring the movements of the indicator closely. He cautioned that if it approaches the extreme greed range, it could signal aggressive profit-taking and a potential trend reversal.

G a a h emphasized that sustained moderate optimism could lead to continued upside potential, highlighting the importance of risk management in this market environment.

The SOPR suggests that the top has not yet been reached; balancing optimism and caution is crucial for maximizing gains and protecting capital from volatility.

Featured image created with DALL-E, Chart from TradingView