0 0

Bitcoin Breaks $95,000 as OG Selling Pressure Declines

Bitcoin Breaks $95,000 Mark

- Bitcoin has surged above the $95,000 level for the first time since mid-November.

- The market is divided on whether this is a constructive breakout or merely a relief move within a bearish trend.

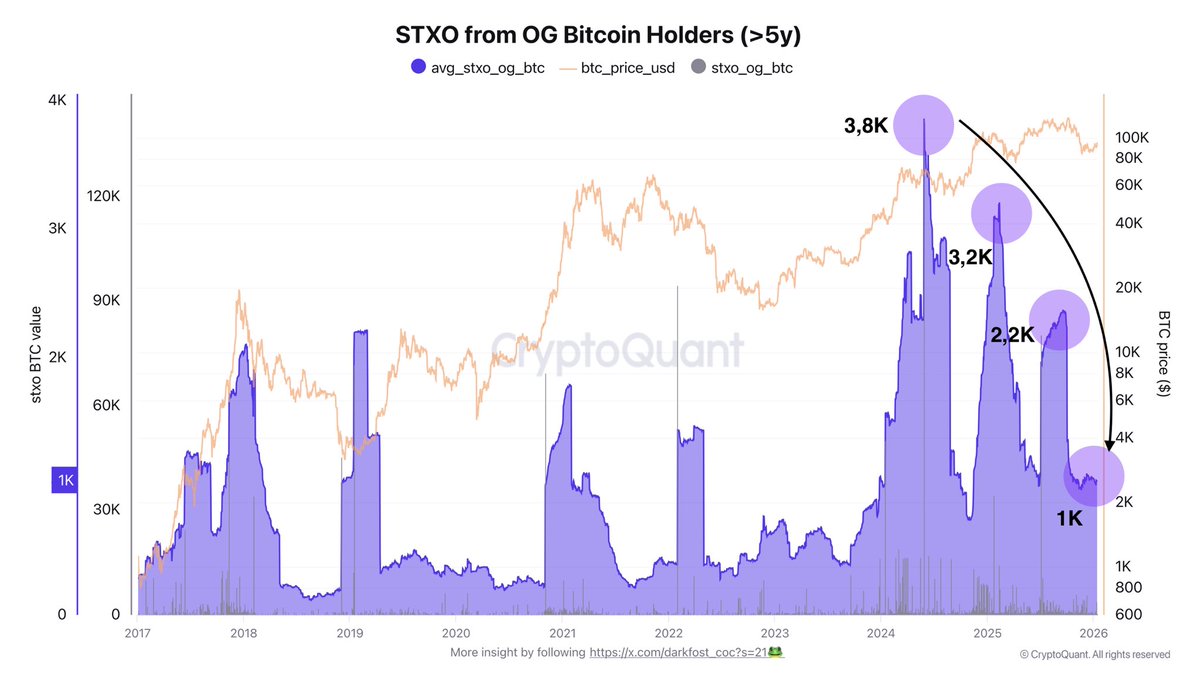

OG Bitcoin Holders' Activity Declines

- An analysis by Darkfost indicates a sharp decline in activity from OG Bitcoin holders.

- Long-dormant coins are not being aggressively distributed, reducing structural sell pressure.

- This shift suggests less urgency to sell among long-term holders despite elevated prices.

Market Implications

- With reduced OG selling, price action is now more influenced by short-term demand and derivatives positioning.

- This change may lead to either consolidation or trend continuation.

Resistance and Market Dynamics

- Bitcoin's recent rally has reclaimed a key resistance around $95K–$96K.

- Volume remains moderate, driven by steady demand rather than speculation.

- Despite the breakout, Bitcoin still trades below longer-term moving averages.

- A sustained hold above $95,000 could push it towards the $98,000–$100,000 range.

- Failure to maintain current levels might lead to a retest of the $90,000–$92,000 support zone.