Bitcoin Hits $99,500 as Long-Term Holders Begin Profit-Taking

Bitcoin has reached new all-time highs for four consecutive days, recently hitting $99,500. This surge has generated bullish sentiment among investors, anticipating a breakthrough of the $100,000 mark. However, on-chain data indicates potential challenges as signs of profit-taking emerge.

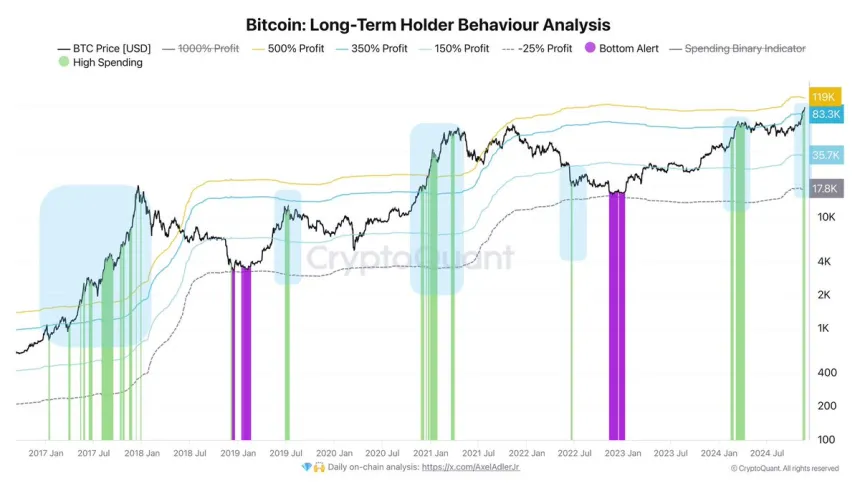

Insights from CryptoQuant reveal that Long-Term Holders (LTHs) are spending their Bitcoin, realizing profits exceeding 350%. This behavior indicates that some seasoned investors are locking in gains after the recent uptrend. Whale activity and LTH profit-taking could slow the rally and trigger a consolidation phase before any further increases.

While Bitcoin remains shy of the six-figure milestone, the market is evaluating whether it can maintain momentum or if a pullback is imminent. Consolidation at current levels could lay the groundwork for BTC to reclaim its bullish trend and surpass the psychological $100,000 barrier.

Bitcoin Rally Seems Unstoppable

Since November 5, Bitcoin has surged 45%, reflecting strong upward momentum. Despite rising selling activity, demand continues to support price increases, pushing Bitcoin to new highs. Market participants are monitoring for potential signals of a slowdown or correction as BTC enters uncharted territory.

CryptoQuant analyst Axel Adler highlighted trends among LTHs, noting that their active spending of Bitcoin may signal shifts in market sentiment. If Bitcoin's price exceeds $119,000, LTH profits could rise above 500%, potentially triggering significant selling pressure and leading to a major correction. However, predicting an exact price point for such a correction remains speculative.

This interaction between demand and LTH profit-taking highlights the need for careful market observation. Traders should remain cautious amid Bitcoin's rapid ascent.

BTC About To Reach $100K

Currently trading at $98,600, Bitcoin is less than 2% from the anticipated $100,000 mark, which is expected to act as a significant supply zone. Recent price action has limited opportunities for traders to buy at lower levels, frustrating those aiming to accumulate during dips.

If Bitcoin maintains support above $93,500 in the coming days, market sentiment suggests a powerful surge beyond $100,000 could follow. Surpassing this level would likely enhance bullish momentum and drive Bitcoin into new territory.

Conversely, failure to sustain support at $93,500 could lead to selling pressure and a price pullback. In this scenario, Bitcoin might test lower demand zones, with $85,000 and $80,000 identified as key levels for potential accumulation opportunities.

As Bitcoin approaches this historic milestone, the following days will be crucial in determining whether the market sustains its bullish trend or enters a consolidation phase. Traders and investors should remain vigilant during this critical period.

Featured image from Dall-E, chart from TradingView