2 0

Bitcoin Holds Above $110,000 Support as Market Digests Volatility

Bitcoin is currently trading around $111,000 after a decline from its all-time high of $124,500. Key points include:

- Price remains above the critical $110,000 support, but upward momentum is weak.

- Analysts warn of potential deeper corrections if buying pressure does not increase.

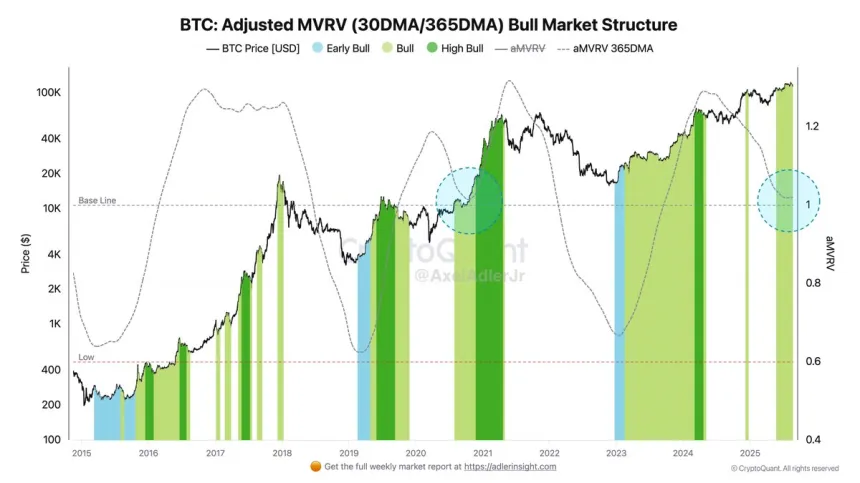

- The Adjusted MVRV metric indicates a balancing phase, with the short-term average nearing the long-term average.

- This 1.0 level historically signals a pause in bullish cycles rather than an end.

- Recent dynamics show profit-taking and volatility being absorbed, indicating consolidation rather than capitulation.

Over the next weeks, Bitcoin's behavior around the $110,000 support will be crucial for determining its direction.

Current Support Levels

Bitcoin continues to face challenges at the $110K support zone, which is vital for both bulls and bears. Key technical indicators are:

- 50-day SMA is around $116,600 acting as resistance.

- 100-day SMA near $111,600 also serves as resistance.

- 200-day SMA at approximately $101,000 indicating deeper support.

- A drop below $110K may lead to testing the $100K–$107K range.

- To regain bullish momentum, Bitcoin needs to reclaim the $115K–$117K region.

The market displays uncertainty, with sellers actively resisting at the $123K level last week.