Bitcoin Holds Above $69,000 Amid Panic Selling by Short-Term Investors

Bitcoin is currently trading above $69,000 after a pullback from recent highs of $73,600. It remains just below the critical resistance level of $73,794, which, if surpassed, would initiate price discovery for the cryptocurrency.

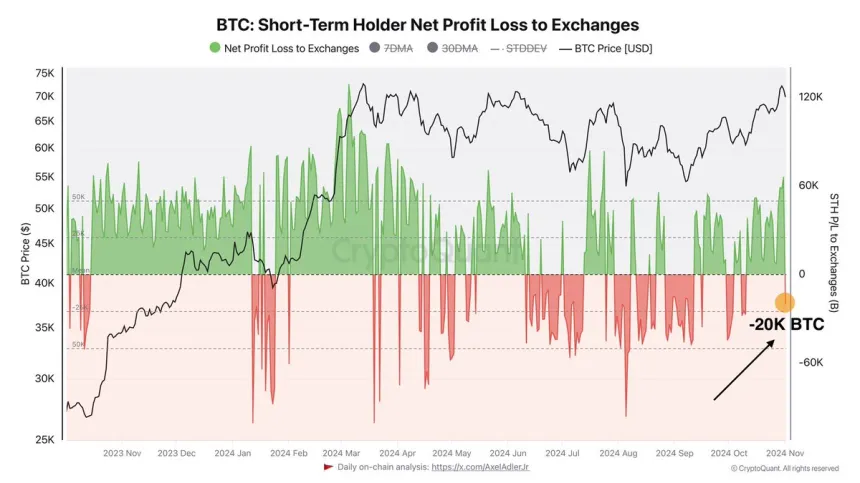

Data from CryptoQuant indicates that short-term holders are facing a net loss of 20 BTC, suggesting panic selling among retail investors. This behavior may precede a price surge as long-term holders accumulate BTC at lower prices. Historically, such sell-offs have led to upward momentum when longer-term holders capitalize on the situation. Maintaining support above $69,000 enhances the likelihood of breaking past the all-time high.

Market observers are monitoring the resistance level closely, as a breakout could trigger significant buying interest and potentially lead to new highs. The upcoming days may be crucial for Bitcoin's trajectory.

Bitcoin Weak Hands Selling

Recent attempts by Bitcoin to reach new highs have resulted in a consolidation phase, influenced by key events such as the U.S. election and the Federal Reserve's interest rate decision. Analyst Axel Adler shared that short-term holders show a negative profit-to-loss ratio of -20 BTC, indicating panic selling amid market volatility.

Adler advocates for a long-term holding strategy during turbulent periods, emphasizing that patience has historically benefited BTC investors during retracements. A successful breakout beyond the all-time high could signal the onset of a broader bull run.

The Federal Reserve's interest rate decision and potential election outcomes could create favorable conditions for Bitcoin to surpass its all-time high. Achieving this milestone would confirm a bullish outlook for BTC and likely stimulate a rally across the cryptocurrency market.

BTC Holding Above Key Support

Currently priced at $69,620, Bitcoin has retraced from recent highs but maintains strong support above $69,000, a level that previously acted as resistance since late July. This support bolsters positive market sentiment.

If Bitcoin sustains its position above $69,000, it may push towards all-time highs. A breach of this resistance could lead to increased bullish momentum and price discovery. Conversely, a dip below this level might indicate a need for a deeper correction to attract buyers for future upward movement.

The $69,000 mark is crucial for market confidence; losing it could necessitate a search for lower support levels before another attempt at new highs. As long as this support holds, the market anticipates further upward momentum in the coming days, with bulls closely monitoring this level to determine the next phase of Bitcoin's bull run.

Featured image from Dall-E, chart from TradingView