Bitcoin Holds Strong Above $88,700 Amid Reduced Selling Pressure

Bitcoin traded between $91,700 and $88,700 over the weekend, indicating strong price stability. The ability to maintain this range highlights Bitcoin's strength and increasing market confidence.

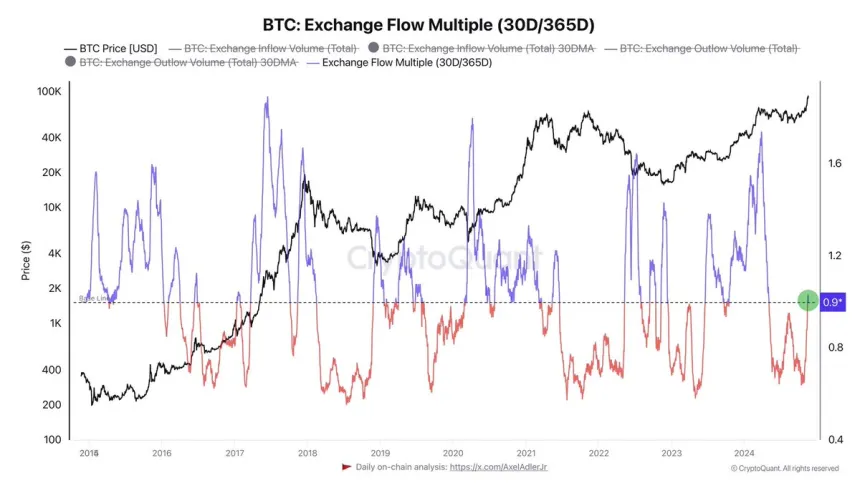

Data from CryptoQuant shows a significant decrease in selling pressure, with fewer sellers contributing to a bullish sentiment that supports Bitcoin’s momentum. A constrained supply alongside rising demand could drive BTC higher, reinforcing its weekend performance.

This positive outlook has led to forecasts of potential aggressive price increases in the coming months. Analysts believe that limited selling pressure combined with growing demand positions Bitcoin for a major breakout.

Bitcoin Flow To Exchanges Supports Bulls

Bitcoin experienced a 39% increase in nine days, marking one of the most substantial upward moves in this cycle. This rally has created excitement among analysts and investors, although opportunities to purchase at lower prices are diminishing.

CryptoQuant analyst Axel Adler points out that the average flow of Bitcoin to exchanges over the past month has not exceeded the average volume from the previous year, suggesting holders prefer to retain their assets instead of selling during the rally.

The reduced selling pressure indicates potential for further price increases as demand grows. However, analysts suggest that a consolidation phase within the current price range would be beneficial, allowing stabilization and stronger support for future growth.

BTC Less Than 2% Away From ATH

At $91,700, Bitcoin is nearly 2% below its all-time high (ATH) of $93,483. This proximity to record levels has increased investor optimism, with expectations for Bitcoin to surpass the ATH again soon. Strong demand and bullish market sentiment support Bitcoin’s price action.

Bitcoin's sustained strength is attributed to its ability to hold key levels during consolidation periods, suggesting continued buyer dominance and the potential for another breakout above $93,483. Analysts anticipate that breaching this level could trigger a new wave of aggressive buying, pushing Bitcoin further into uncharted territory.

However, caution is advised; a drop below $87,000 could indicate a retracement, potentially leading to a short-term correction. Such a move might provide a healthier base for future growth, allowing for consolidation and attracting new demand.

Featured image from Dall-E, chart from TradingView