Four Bitcoin Indicators Signal Bullish Trend Amid Market Decline

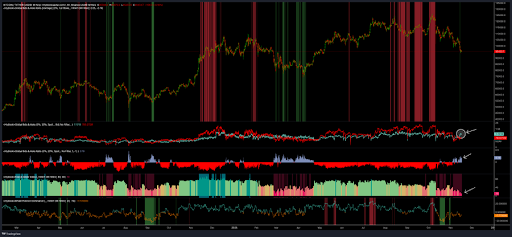

Crypto analyst Dom reports that four Bitcoin indicators, known for signaling previous rallies, have turned bullish. This occurs as BTC drops below $90,000 for the first time in seven months.

Key Insights:

- Four Hyblock indicators now favor bulls, similar to setups during past reversals.

- Indicators suggest limited downside each time they appeared over the last two years.

- Potential for one more dip near $90,000 or a local low formation.

The market may be entering a bear phase, but Dom doesn’t foresee deep reversals like previous cycles. He attributes this to market maturity and institutional investor participation, predicting less volatility with potential 30% to 40% drops in bear markets.

Market Conditions:

- CryptoQuant CEO Ki Young Ju notes weak short-term conditions and slow dollar liquidity.

- Tight funding markets and reduced Bitcoin inflows observed.

- If rate cuts occur or easy-money narratives emerge, liquidity could return to Bitcoin ETFs.

- Stablecoin adoption and reverse ICOs by public companies may push traditional assets onto DEXs.

Ki Young Ju suggests the crypto ecosystem might focus on assets previously traded only in TradFi, potentially benefiting BTC the most. Meanwhile, altcoins lacking strong narratives may lose liquidity.

Current BTC price is around $90,000, down over 5% in the last 24 hours according to CoinMarketCap data.