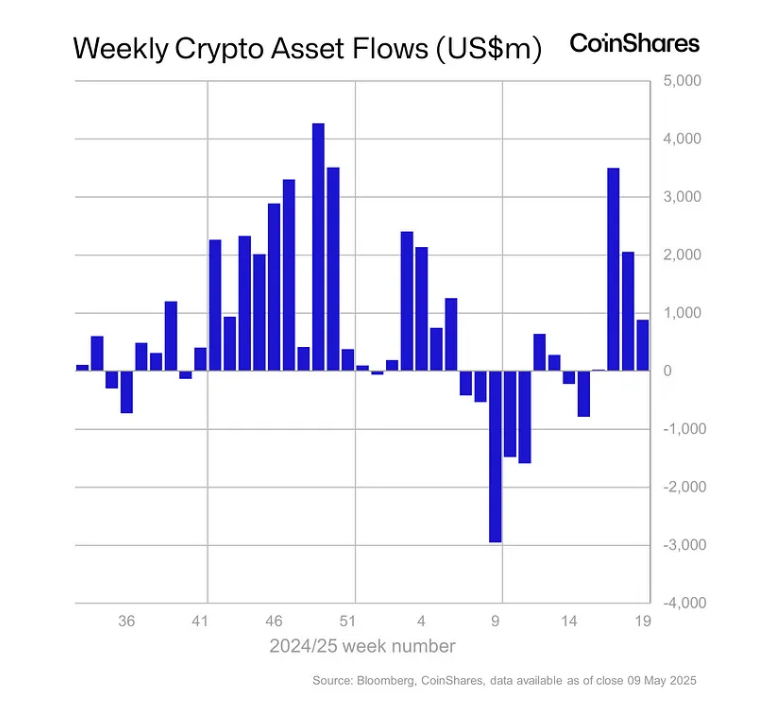

Bitcoin Sees $867 Million Inflows as Crypto Funds Attract $880 Million

Last week, crypto funds attracted over $880 million, bringing total year-to-date inflows to $6.7 billion, according to CoinShares. Prices for Bitcoin reached $105,000 and Ethereum traded above $2,600.

Weekly Inflows Indicate Continued Demand

- Investors contributed $882 million to crypto products last week, marking the fourth consecutive week of inflows.

- Year-to-date net new cash totals $6.7 billion.

Bitcoin Dominates The Inflows

- Bitcoin funds received $867 million, primarily into US-listed ETFs.

- Bitcoin ETFs have accumulated nearly $63 billion since January 2024, surpassing their previous high of $61.6 billion.

- Ethereum products saw only $1.5 million in inflows last week.

Sui gained attention with $11.7 million in inflows, outpacing Solana and Ethereum. Year-to-date, Sui totals $84 million compared to Solana's $76 million. XRP recorded $1.4 million in weekly inflows, totaling $258 million year-to-date.

Regional Flows Favor The US

- The US accounted for $840 million of last week's inflows.

- Germany contributed over $44 million and Australia $10 million.

- Sweden experienced the largest outflows at $12 million, with Hong Kong losing $8 million and Canada $4.3 million.

BlackRock's iShares Bitcoin ETF led with over $1 billion in inflows, offset by $257 million in outflows from providers like Grayscale and Bitwise. Overall trends indicate that money supply expansion and concerns over slow US growth and inflation are driving some investors towards crypto as a hedge.

Featured image from Gemini Imagen, chart from TradingView