5 0

Bitcoin Investors Face Crucial Decision as Market Indecision Persists

Bitcoin is currently trading below the $90,000 mark, indicating market indecision and rising caution. The lack of conviction from both buyers and sellers is evident as Bitcoin struggles to maintain key psychological levels.

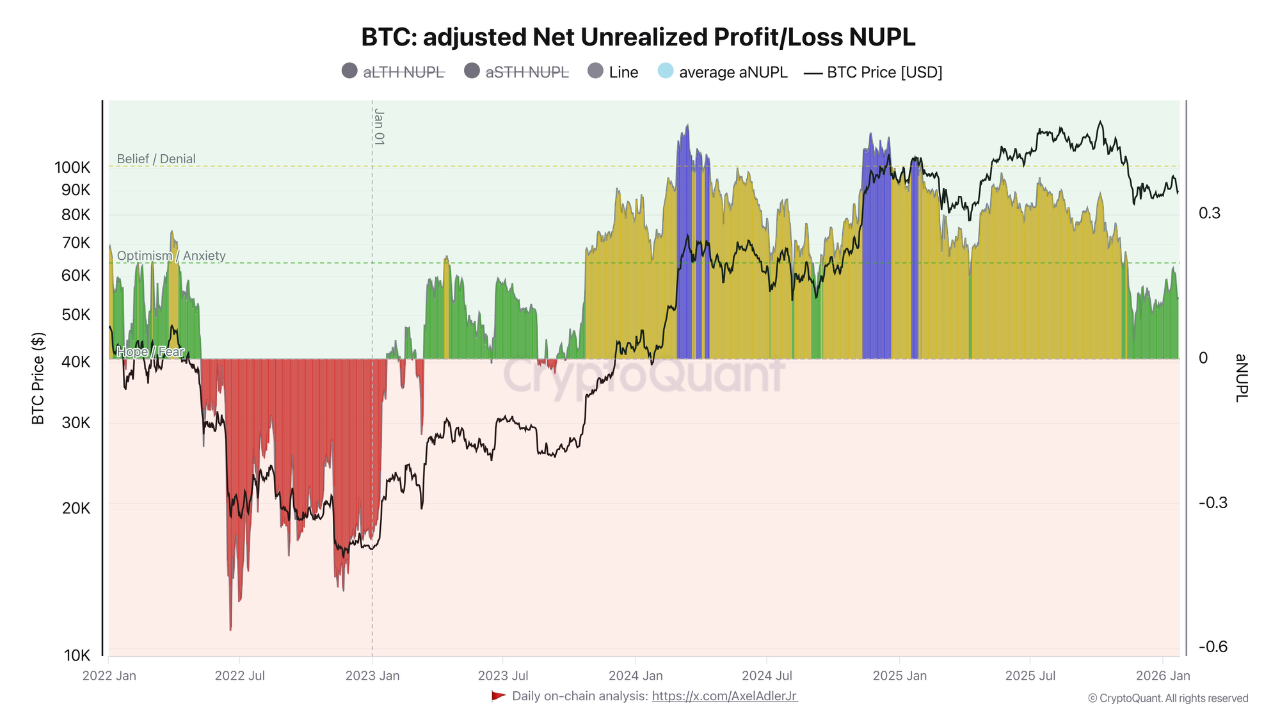

- On-chain analysis by Darkfost highlights conditions similar to the end of prolonged bear markets, where unrealized profits and losses suggest underlying stress in the market.

- The shift in profit/loss dynamics pressures investors to either hold through volatility or exit under stress.

Decision Point for Bitcoin Investors

- Darkfost's analysis using an adjusted NUPL model incorporates realized capitalizations of Short-Term Holders (STHs) and Long-Term Holders (LTHs), offering a clearer view of market stress.

- Bitcoin is nearing levels that historically force investors to decide between holding or capitulating, impacting liquidity and sentiment.

- If long-term holders withstand pressure, the market may stabilize; otherwise, increased selling could deepen a bear phase.

Bitcoin Consolidates After Sharp Weekly Breakdown

- Bitcoin trades around $89,000 after a 4.8% weekly drop, breaking out of its previous distribution zone.

- The market is caught in a tight range, awaiting confirmation before a significant move.

- BTC remains vulnerable, trading below resistance levels near the low-$100K region.

- A defense of the $88K–$90K range and a push above $92K–$95K may signal recovery; failure increases risk of retracement toward the low-$80K zone.