7 0

Bitcoin Investors Show Increased Selling Pressure as Bull Cycle Matures

Bitcoin is currently trading around $114,690 after a decline to the $112,000 zone. Investor concerns about a potential bear market have increased following this drop.

Key points:

- Short-term holders face losses or underwater positions, leading to panic.

- Analyst Axel Adler suggests the broader uptrend remains intact despite typical late-stage bull cycle behavior.

- Long-term holders are still profitable and show no signs of capitulation, providing support for Bitcoin's price structure.

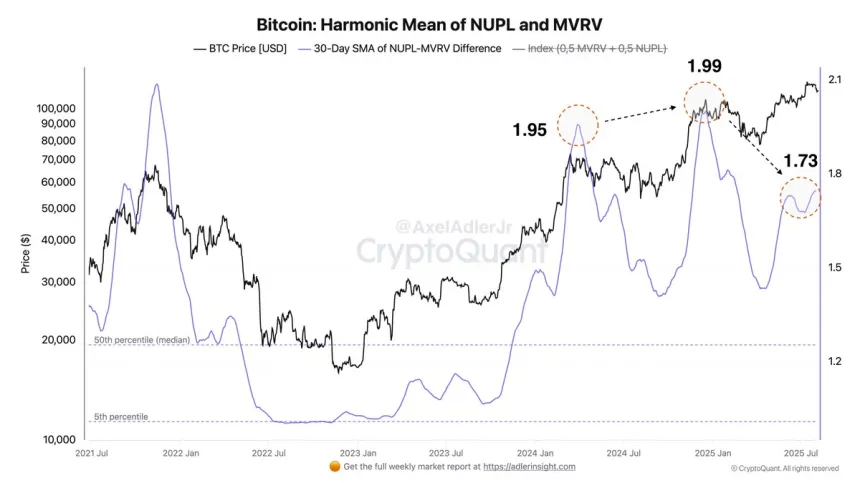

- The Bitcoin Harmonic Mean of NUPL and MVRV indicates a shift in investor behavior as profit-taking increases.

- Adler expects two more significant rallies due to anticipated Federal Reserve rate cuts but warns of potential selling pressure from long-term holders afterward.

- Current resistance level is $115,724; failure to break this could indicate bearish control.

- Volume is low compared to previous rallies, with key support levels at the 100-day SMA ($107,926) and 200-day SMA ($99,345).