4 0

BULLISH 📈 : Bitcoin emerges as key player in AI-driven energy economy

CryptoQuant CEO Ki Young Ju supports the idea that Bitcoin equates to energy, suggesting it serves as a settlement layer for an AI-driven economy where power is the main constraint. He argues that Bitcoin can accurately price energy, unlike traditional commodities.

- Simon Kim of Hashed posits that the critique of Bitcoin's energy use is shifting from morality to economic pragmatism due to the rise of AI data centers.

- Significant investments have been made in Bitcoin and energy-related projects, such as Abu Dhabi sovereign wealth fund Mubadala's investments in BlackRock’s Bitcoin ETF and Crusoe Energy.

- Bitcoin miners have built infrastructure crucial for AI, focusing on power security and thermal management.

- Electricity constraints make flexible energy consumption economically valuable, with examples like curtailed renewable energy exceeding 200TWh annually.

- In Texas, mining has been classified as a controllable load resource, offering financial incentives during peak demand periods.

- The environmental impact of Bitcoin mining is improving, with over half of the energy used coming from sustainable sources.

- Flare-gas mining reduces emissions compared to flaring, positioning Bitcoin mining as a solution for surplus energy monetization.

The discourse suggests Bitcoin's role in the energy market may grow, focusing on its ability to measure and monetize energy scarcity. The debate shifts towards Bitcoin's place in AI-era infrastructure rather than its existence.

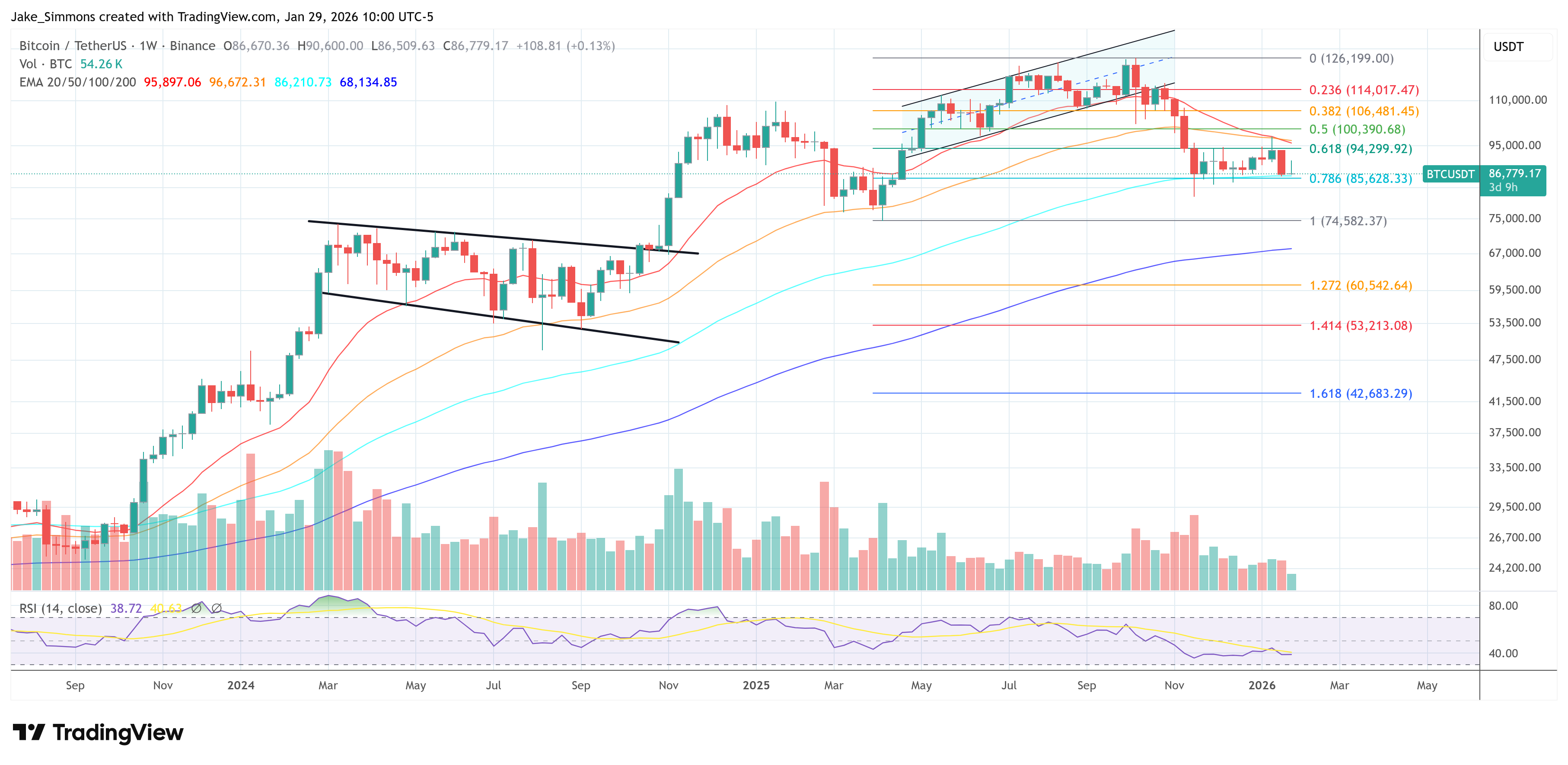

At press time, Bitcoin was trading at $86,779.