7 0

Bitcoin Faces Key Resistance at $93,000 Amid Ongoing Downtrend

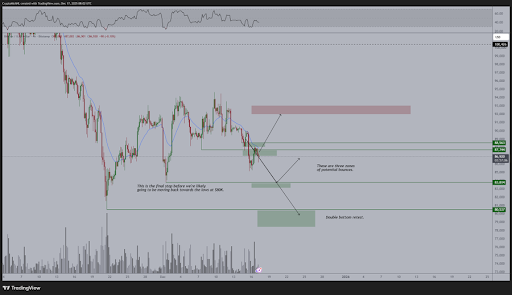

Bitcoin is at a decisive point, clinging to crucial weekly support while momentum fades. Despite holding above a significant zone, repeated rejections suggest waning buyer control. Macro pressures and untested liquidity levels could dictate the next move, possibly stabilizing BTC or triggering a deeper decline.

Short-Term Downtrend Persists

- Analyst Michael Van De Poppe notes Bitcoin's rejection at a key resistance level, maintaining the short-term downtrend.

- A breakout above $88,000 is needed to reverse this trend and signal potential upward momentum.

- Failure to break out may lead to testing liquidity at $83,000, with potential further declines to $80,000.

- Upcoming macroeconomic events could increase market volatility.

Challenges at $93,000 Resistance

- Bitcoin faced rejection at $93,000 but maintains structure above the $86,000 support zone, supported by the 100-week moving average.

- The broader structure suggests possible deeper downside, aligning with the April low around $78,000.

- A potential retest of the $70,000 level is seen as a long-term buying opportunity if the pullback extends.