Bitcoin Faces Risk of Losing Key Support Zone Amid Market Decline

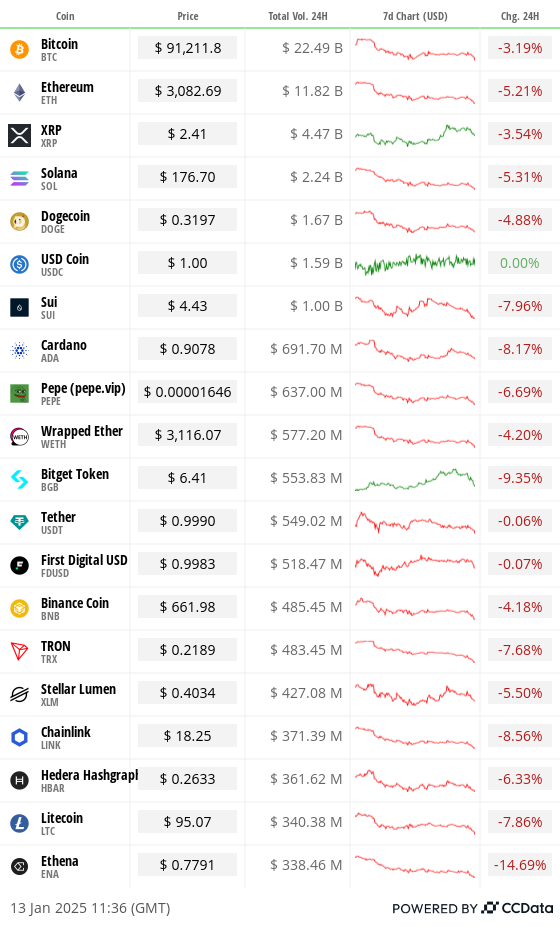

Risk assets are declining as the dollar index and Treasury yields rise following a strong U.S. jobs report. Bitcoin (BTC) is down 2%, trading in the $90,000 to $93,000 support zone. Ethereum (ETH) has hit its lowest level since December 21, while alternative cryptocurrencies are experiencing larger losses. XRP's bullish outlook is under pressure despite whale accumulation over the weekend. The AI coin sector is the worst performer.

Michael Saylor signaled MicroStrategy's continued interest in Bitcoin with a recent purchase of approximately $100 million. Investment banks suggest the Fed's rate-cutting cycle may be over, with Bank of America hinting at a potential rate hike. Observers predict BTC could drop to $70,000 before recovering.

The Coinbase-Binance BTC price differential shows weaker demand, reaching its lowest since 2019. Focus will shift to upcoming events such as Donald Trump's inauguration and ongoing FTX claim distributions.

Market Updates

- BTC down 3.12% to $91,392.04

- ETH down 4.78% to $3,109.45

- CoinDesk 20 index down 2.15% to 3,310.23

- BTC funding rate at -0.0149%

- DXY up 0.35% at 110.04

- Gold down 0.13% at $2,705.00/oz

- Silver down 0.84% to $30.83/oz

Token Events

- Jan. 13: Solayer (LAYER) airdrop snapshot

- Jan. 15: Derive (DRV) token generation event

- Jan. 16: Sonic token (S) trading starts on Binance

- Jan. 17: SOLV token primary listing

Technical Analysis

XRP broke out of a descending triangle but is facing resistance after BTC's risk-off actions. A failed breakout could indicate bearish trends.

Crypto Equities

- MicroStrategy (MSTR): closed at $327.91, pre-market down to $311.67

- Coinbase Global (COIN): closed at $258.78, pre-market down to $247.34

- Galaxy Digital Holdings (GLXY): closed at C$27.07

AI agent tokens have dropped significantly, with ai16z down over 60% from its January peak. NFT project Azuki announces a new token distribution aimed at community engagement. Ethena's ENA token has also seen a decline as ETH funding rates stabilize.

Derivatives Positioning

Perpetual funding rates for several altcoins have turned negative, indicating bearish sentiment. Protective put options for BTC and ETH are being purchased amidst market uncertainty.

Overnight Flows

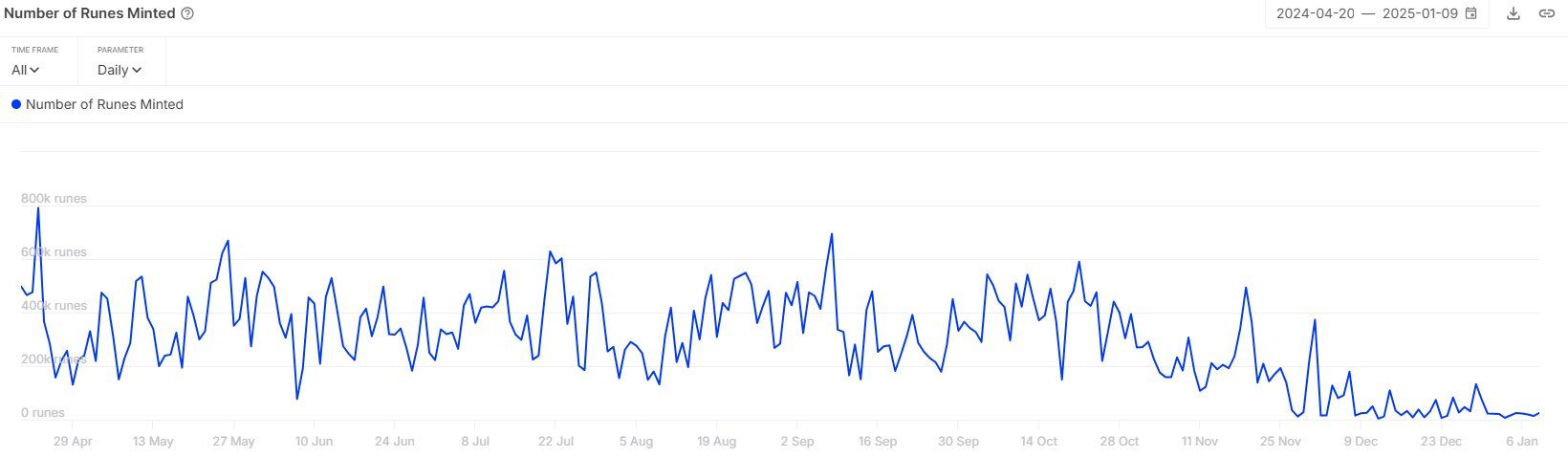

Chart of the Day

Daily minting of Bitcoin Runes has decreased to record lows, averaging below 10% of last year's figures.