Bitcoin Leads $3.4 Billion in October Crypto Fund Inflows

Investment activity in digital assets surged throughout October, with significant inflows into crypto investment products, particularly Bitcoin, as reported by CoinShares.

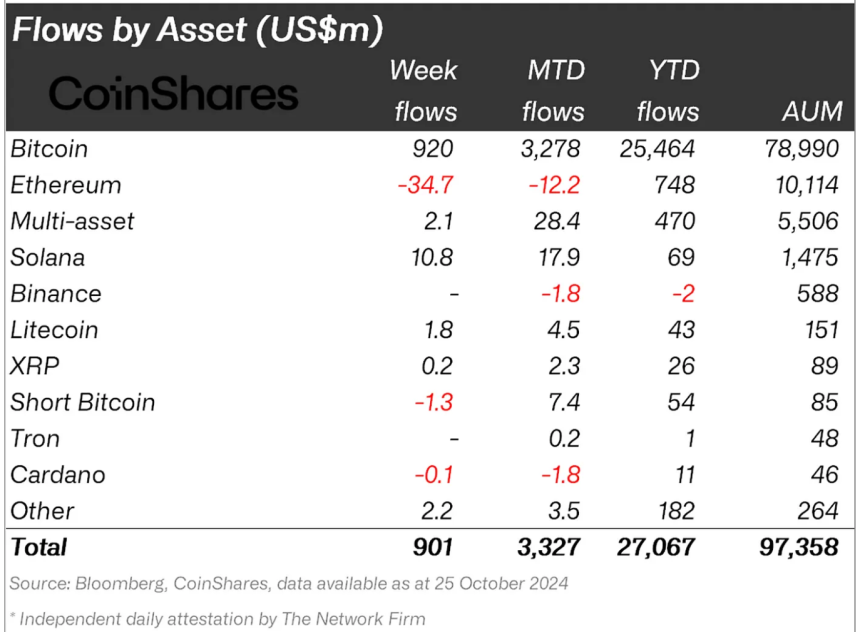

Last week, global crypto funds attracted $901 million in net inflows, totaling $3.4 billion for the month.

Bitcoin Dominates Inflows As Ethereum Sees Outflows

CoinShares indicated that Bitcoin-centric investment products accounted for the majority of inflows, with $920 million in net additions last week.

US spot Bitcoin exchange-traded funds (ETFs) recorded $997.6 million in net inflows, primarily from BlackRock's iShares Bitcoin Trust (IBIT).

Bitcoin's dominance was evident, with blockchain equities and Solana-based products also seeing inflows of $12.2 million and $10.8 million, respectively.

Conversely, some Bitcoin-based products outside US markets experienced net outflows. Ethereum-based funds saw net outflows of $34.7 million last week, indicating a decline in investor interest.

Ethereum’s price ratio to Bitcoin reached its lowest since April 2021, potentially contributing to this trend.

The data suggests a shift in focus towards Bitcoin among investors, possibly due to expectations of regulatory clarity and mainstream adoption through developments like spot ETFs.

Regional Trends And Behind The Boom

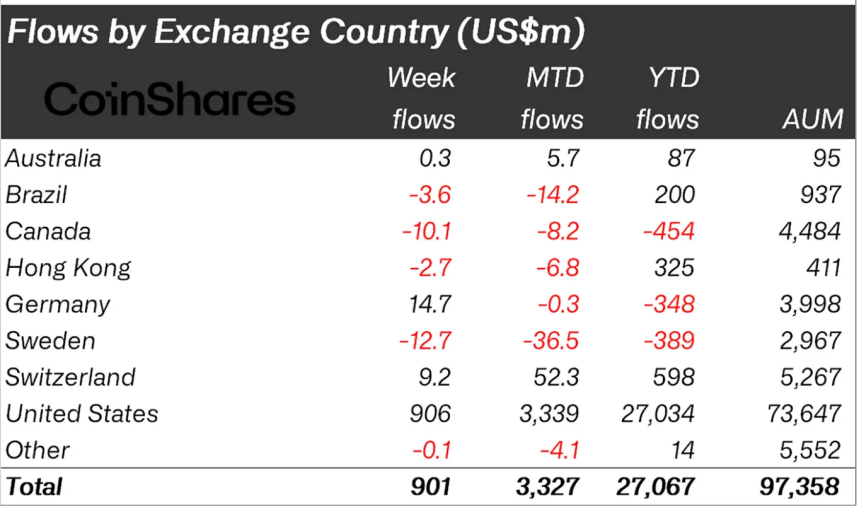

US-based crypto funds attracted $906 million in net inflows last week, while other regions, including Sweden, Canada, Brazil, and Hong Kong, faced $29.1 million in net outflows.

This disparity highlights the increasing influence of the United States on the global crypto investment market, especially as firms like BlackRock and Fidelity expand their crypto offerings.

According to CoinShares Head of Research James Butterfill, the political climate is likely influencing recent Bitcoin price movements and inflows, with Republican gains correlating with increased interest in Bitcoin investments.

This indicates that market participants may expect a shift in political power favorable to digital assets, potentially spurring anticipation of regulatory reforms and greater crypto acceptance.

CoinShares reports that October's influx represents approximately 12% of assets under management (AUM) in digital asset funds, marking the fourth-largest month for inflows on record. Year-to-date totals reach $27 billion, nearly tripling the previous high of $10.5 billion set in 2021.

Featured image created with DALL-E, Chart from TradingView