5 1

Bitcoin Lending Resurgence in Decentralized and Centralized Finance

Key Insights on Crypto-Backed Lending and Tokenized Stocks

- Crypto lending has roots in traditional financial methods, such as Lombard lending, and is now prevalent in both DeFi and CeFi systems.

- The liquidity of cryptocurrencies like Bitcoin and tax advantages drive interest in crypto-backed loans.

- Initial bitcoin lenders emerged around 2013 with institutional players like Genesis and BlockFi coming during the ICO boom of 2016-2017.

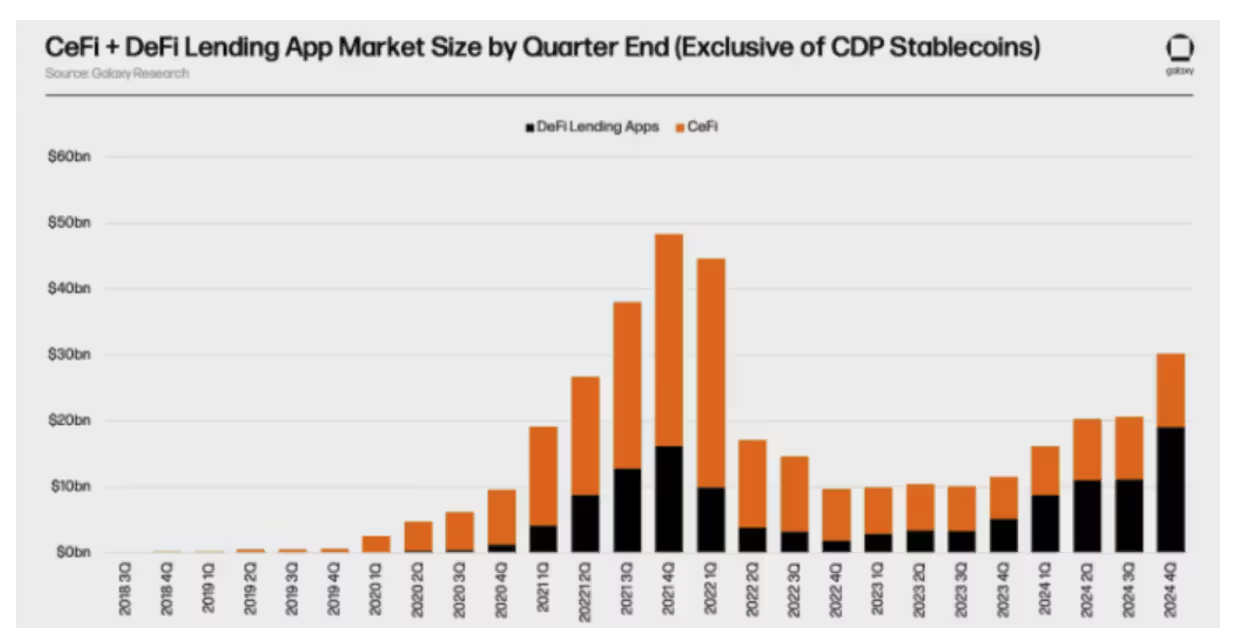

- CeFi saw significant failures in 2022 due to poor risk management, leading to bankruptcies of firms like Celsius and BlockFi.

- DeFi platforms have regained strength due to greater transparency, pushing TVL near 2021 levels.

- CeFi is expected to persist alongside DeFi, catering to institutional needs for regulatory clarity.

Navigating the Future of Tokenized Securities

- Nasdaq's integration of tokenized securities aims to enhance distribution, efficiency, and transparency.

- The global tokenized asset market has grown significantly, reaching $30 billion in 2023.

- Challenges include technical integration with legacy systems and regulatory clarity, especially concerning token rights.

- Security remains a priority given the rise in cyberattacks related to blockchain technologies.

- Nasdaq seeks to ensure tokenized stocks offer the same rights as traditional securities, preventing investor disadvantages observed in Europe.

Further Developments

- BlackRock’s spot ETF IBIT now supports in-kind creation and redemptions of bitcoin.

- Canadian authorities dismantled an illegal crypto trading platform, seizing over $56 million.

- The Bank of England considers stablecoins as a potential transformative element in the UK banking system.