5 0

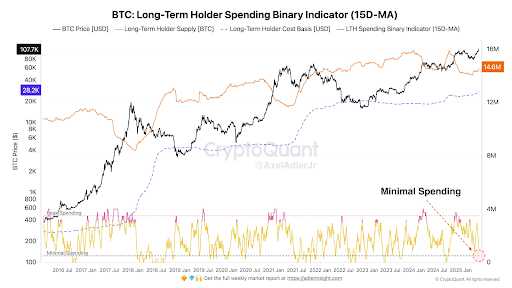

Bitcoin Long-Term Holders Increase Accumulation Amid Minimal Selling Activity

Bitcoin has traded between $106,229 and $111,807 over the past five days, maintaining a price above $108,000 despite increased selling pressure from miners. On-chain data indicates that long-term holders are absorbing this selling pressure.

Long-Term Holder Accumulation

- The Long-Term Holder (LTH) Spending Binary Indicator is at its lowest since September 2024.

- The 15-day moving average for LTH spending is now in the minimal zone, historically preceding bullish trends.

- Approximately 300,000 BTC has been added to long-term holder supply in the last 20 days, totaling 14.6 million BTC held by long-term investors.

- This trend suggests strong conviction among long-term holders, who are accumulating instead of selling.

Market Implications

- The increase in long-term holder supply and minimal selling activity indicate market strength.

- Long-term investors show confidence in Bitcoin's valuation, holding despite significant profits.

- Short-term holders have realized over $11.6 billion in profits in the past month.

- A historical parallel shows that a similar pattern in September 2024 led to a 96% surge in Bitcoin’s price.

- If this trend continues, a potential rise could see Bitcoin approaching $212,000.

Current Bitcoin trading price is $109,000.