9 0

Bitcoin Faces Pressure as Long-Term Holders Increase Market Selling

Bitcoin (BTC) is facing renewed selling pressure, with potential to drop below the $110K support level if current trends continue. This reflects a shift in market sentiment as recent bullish momentum weakens.

- Despite bearish pressures, some analysts believe BTC can stabilize and potentially rise again if buying demand returns, influenced by macro conditions or institutional flows.

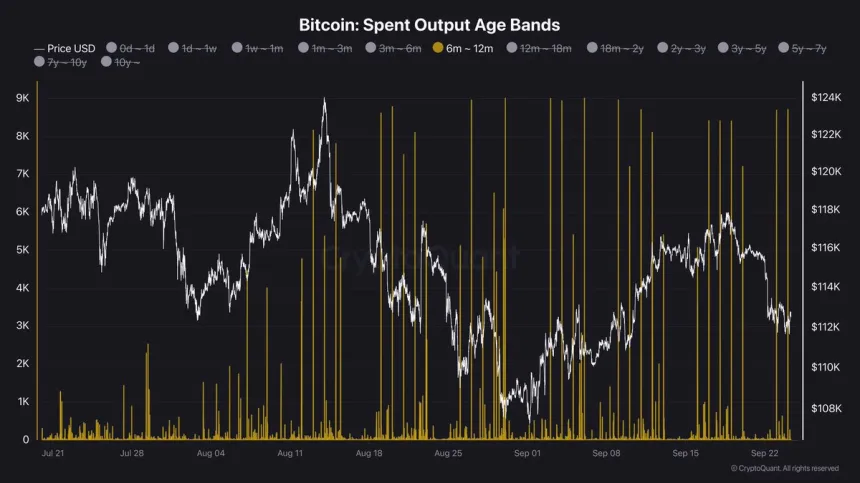

- Analyst Darkfost notes increased market activity from mid-term holders, with BTC aged 6–12 months entering the market, indicating a possible change in sentiment.

- Long-term holders control approximately 80–85% of Bitcoin's supply, significantly impacting price dynamics when they sell.

The Bitcoin Spent Output Bands indicator shows increased onchain flow from experienced holders, aligning with recent bearish momentum.

- Institutional accumulation and shrinking exchange reserves support a long-term bullish outlook despite near-term challenges.

- If BTC holds above key liquidity zones and overcomes LTH distribution, it may regain momentum toward all-time highs.

- Current trading is around $112,567, rebounding slightly after hitting lows of $111,135.

- Resistance at $123,217 remains strong, while immediate support is around the $112K–$110K range.

- The 50-day SMA at $114,322 and the 100-day SMA at $113,382 are now resistance levels, indicating weakened short-term momentum.

- Repeated tests of the $112K region could risk a breakdown if bullish momentum does not return.