Updated 18 December

Bitcoin Long-Term Holders Experience Significant Selloff Amid Price Surge

On-chain data indicates that Bitcoin long-term holders are selling. This analysis explores whether the current selloff is significant enough to signal a price peak.

Bitcoin Long-Term Holders Have Been Selling

Analyst Ali Martinez discussed the historical trend of long-term holder (LTH) holdings in relation to Bitcoin price peaks. LTHs are defined as investors who have held Bitcoin for more than 155 days, contrasting with short-term holders (STHs), who typically exhibit weaker market behavior.

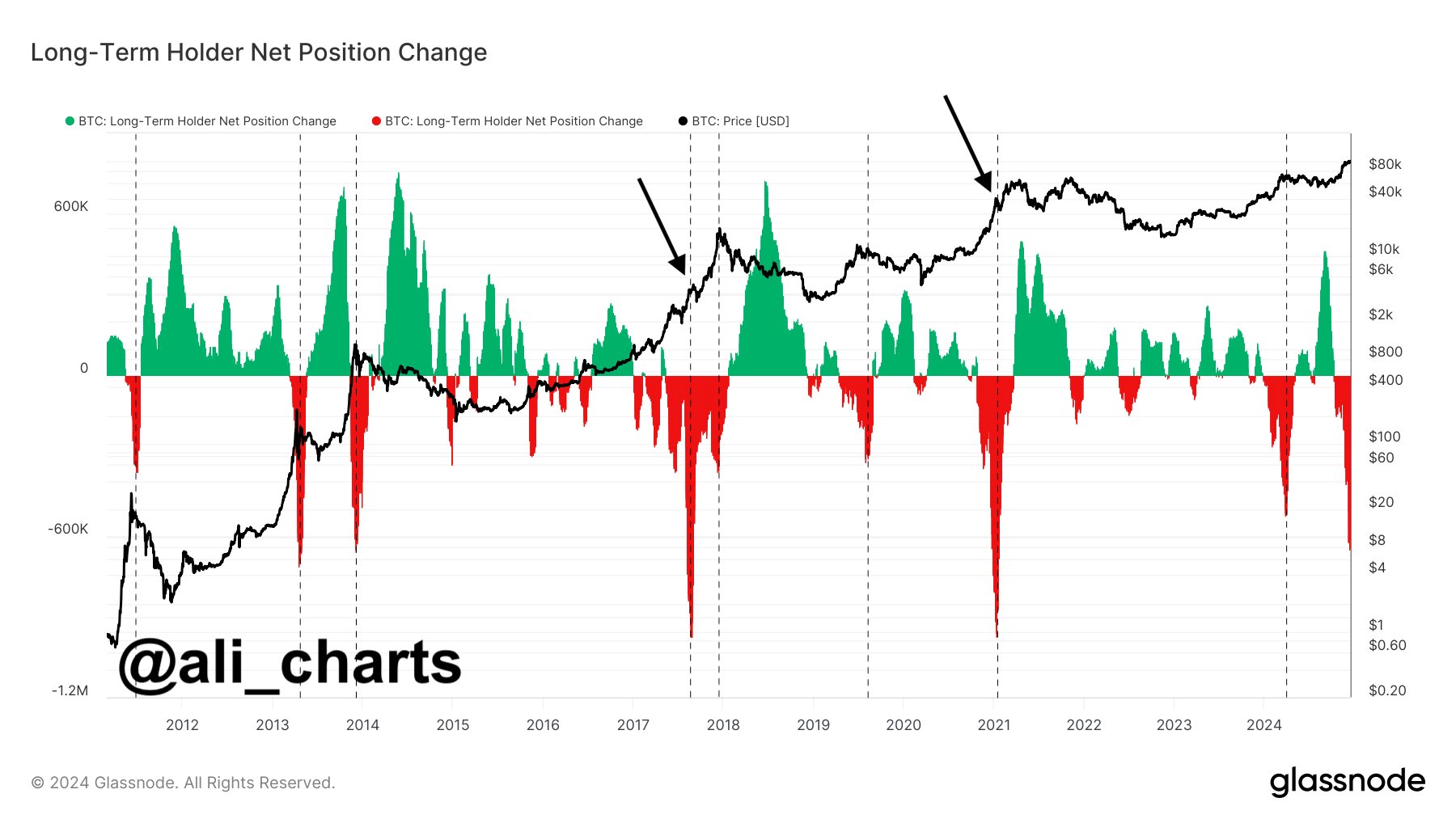

While STH sell-offs are generally inconsequential, LTH sell-offs are noteworthy due to their rarity. The Net Position Change metric tracks Bitcoin inflows and outflows from the LTH cohort. Below is a chart illustrating this indicator's historical trends.

The chart shows a recent sharp decline in the Net Position Change, indicating a net outflow of Bitcoin from LTHs. Similar trends were observed earlier this year, with notable past instances highlighted by Martinez.

Historically, major LTH sell-offs have coincided with price tops. In 2017 and 2021, significant sell-offs occurred before final price surges, suggesting the current sell-off may precede another upward movement leading to a cyclical top for Bitcoin.

The current indicator levels are less negative than during previous major sell-offs in 2017 and 2021, implying a potential continuation of the upward trend. Future developments will clarify if this pattern repeats.

BTC Price

Bitcoin has entered all-time high discovery mode, recently surpassing the $107,000 mark.