7 0

Bitcoin Realized Losses Surge to 2022 Levels After Drop Below $90,000

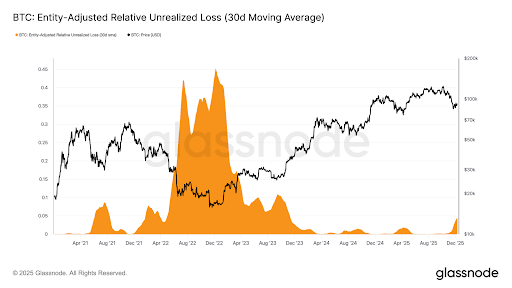

Bitcoin's recent price movements have caused stress among traders, with realized losses reaching levels last seen in 2022.

- Glassnode reports Bitcoin is trading above a critical cost-basis level but under pressure from increased loss realization and reduced liquidity.

- Realized losses have escalated, nearing magnitudes from the 2022 bear market, with Relative Unrealized Loss (30D-SMA) rising to 4.4%.

- The price drop below $90,000 has led many to sell coins at a loss, impacting profitability recovery observed earlier this year.

- Despite a bounce above $92,000, holders continue locking in losses, averaging $555 million per day.

- Investors lack confidence in short-term gains, opting to reduce exposure even at unfavorable prices.

- Long-term holder profit-taking has surged to $1 billion daily, briefly hitting a record $1.3 billion.

Bitcoin remains above the True Market Mean, a key cost-basis support benchmark, suggesting potential revisits to higher price levels near $95,000.

Market Indicators Show Weakness

- ETF flows have weakened after strong inflows earlier, reducing a significant buy-side liquidity source.

- Spot market liquidity has decreased, with major exchange order books near their 30-day range lower bounds.

- Trading activity has declined, offering fewer liquidity flows to manage volatility or sustain moves.

- Derivatives markets reflect caution; funding rates are neutral, and futures open interest remains low.

- Participants are defensive, focusing on Bitcoin's response to the Federal Reserve's recent rate cut.