Bitcoin Realized Losses Surge to $28.9 Million Amid Market Correction

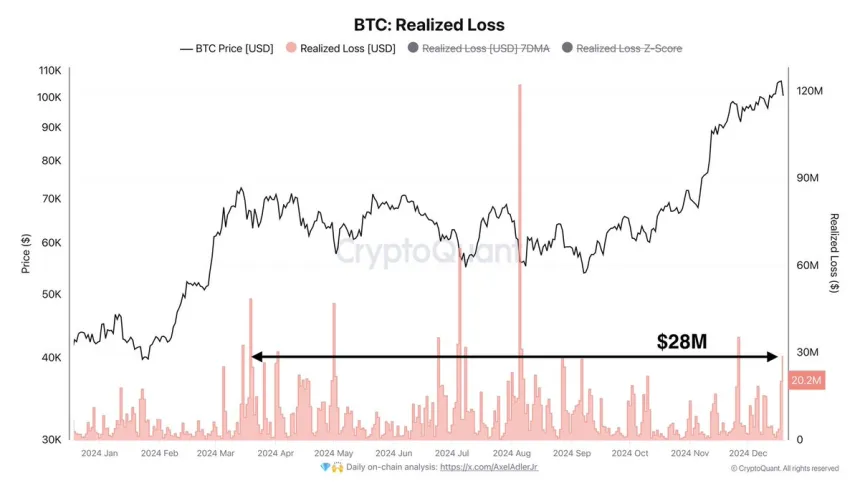

Bitcoin has experienced a significant correction, dropping 13% from its all-time high of $108,364. This decline has shifted market sentiment from bullishness to uncertainty, particularly impacting altcoins that are also facing losses. Key metrics indicate realized losses of $28.9 million, which is 3.2 times higher than the weekly average, suggesting some investors are exiting positions as the market adjusts after a period of growth.

The current situation raises questions about whether this correction is a healthy adjustment within an overall bullish trend or the beginning of a more extensive downtrend. Traders are monitoring Bitcoin’s ability to hold critical support levels and the performance of altcoins, which typically follow Bitcoin's price movements.

Bitcoin Facing Selling Pressure

After two days of aggressive selling, Bitcoin is under considerable pressure, leading to a cautious attitude among analysts and investors. Some are adopting bearish positions as Bitcoin's recent momentum wanes. The surge in realized losses to $28.9 million indicates increased selling activity, but some analysts view this as part of a normal market correction following Bitcoin's rise to $108,300.

Analysts suggest that long-term holders should remain patient during this dip unless further bearish signals arise. Corrections can provide necessary adjustments for future growth as weaker traders exit and stronger ones position themselves strategically.

Market participants are closely observing price action to determine if this correction establishes a solid foundation for future upward movement or indicates further declines.

BTC Holding Bullish Structure (For Now)

Currently trading at $94,400, Bitcoin remains above the key support level of $92,000, essential for maintaining the uptrend. Holding this level suggests resilience and may lead to a rebound if buyers regain control soon.

Despite negative sentiment, Bitcoin's price stability above $92,000 indicates underlying strength. However, restoring confidence is crucial for reclaiming higher price levels and resuming bullish momentum. A failure to maintain this support could lead to further corrections and increased volatility.

Featured image from Dall-E, chart from TradingView