7 0

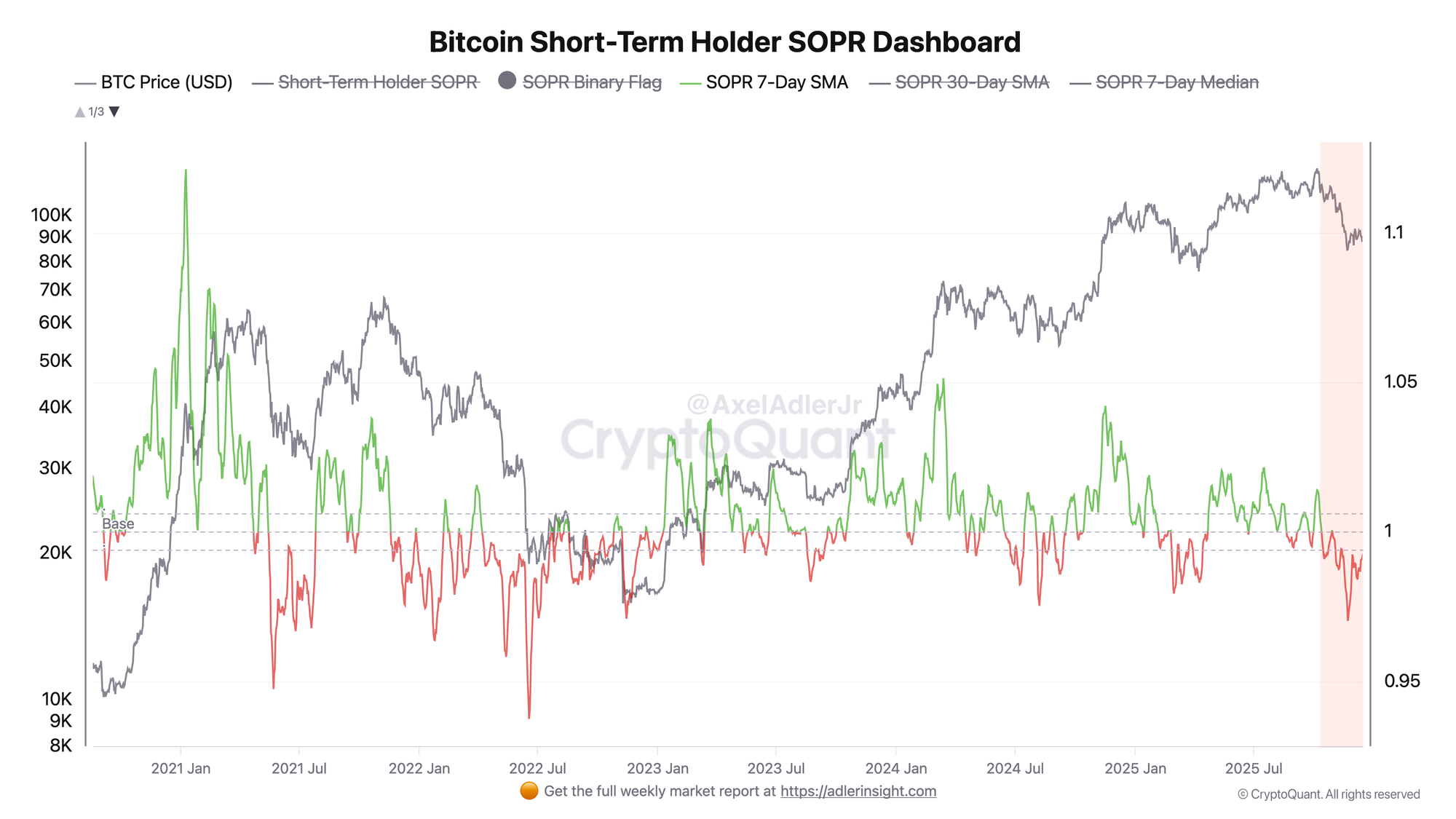

Bitcoin Faces Market Stress as STH SOPR Dips Below 1

Bitcoin is struggling to break past the $90,000 level, showing signs of market pressure and fading momentum. The cryptocurrency has retraced about 30% from its all-time high, reflecting a corrective phase dominated by uncertainty.

- On-chain data highlights market stress beyond price movements.

- Short-Term Holder Spent Output Profit Ratio (STH SOPR) and P/L Block indicators reveal broad loss realization and declining sentiment.

Indicators Signal Capitulation Pressure

- The STH SOPR measures if coins held for under 155 days are sold at profit or loss. A value below one indicates losses.

- The current 7-day average for STH SOPR is near 0.99, showing short-term holders selling below acquisition prices, suggesting emotional selling.

- Historically, similar conditions marked local capitulation phases with selling pressure peaks.

- P/L Block indicator shows pronounced stress with a P/L Score of minus three, aligning with Bitcoin's 30% drop from its peak.

Weekly Price Analysis

- Bitcoin is trading around $89,900 after rejection from $120,000–$125,000.

- It attempts stabilization above the 200-week moving average (green), a key long-term trend level.

- However, it remains below the 50-week moving average (blue), confirming a corrective phase.

- Volume decline signals indecision, suggesting potential volatility expansion.

- Holding $85,000–$88,000 is critical; breaking below could lead to further retracement toward $75,000–$80,000.

- Reclaiming the 50-week MA near $95,000 would indicate easing downside pressure.