4 0

Bitcoin Market Structure Remains Bullish Despite Price Drop, Analyst Says

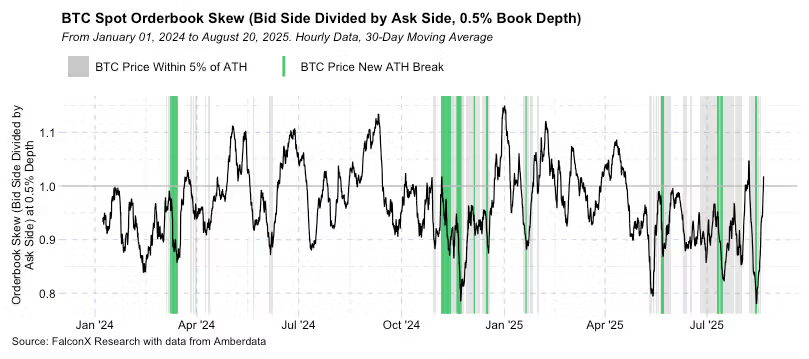

Bitcoin is currently trading nearly $11,000 below its record high from August 14, according to CoinDesk data. FalconX’s head of research, David Lawant, noted that the market's internal structure remains “extremely bullish.”

Key points from Lawant's analysis:

- When Bitcoin experiences small price dips, sell orders quickly diminish while buy orders increase, indicating a shift in the order book from sell-side to bid-side.

- This trend suggests that strong demand, particularly from institutions and well-capitalized funds, is stepping in during downturns, viewing them as buying opportunities.

- The absence of sustained selling reflects confidence in Bitcoin’s long-term trajectory.

Technical analysis highlights include:

- Between Aug. 19 and Aug. 20, Bitcoin traded in a range of $1,899.78, with a low of $112,437.99 and a high of $114,337.77.

- On Aug. 20 at around 13:00 UTC, the price fell to $112,652.09 but rebounded strongly.

- This rebound was backed by high trading volume, with 14,643 BTC exchanged compared to a 24-hour average of 9,356 BTC.

- The established support corridor is between $112,400 and $112,650.

- In the last hour of the analysis period, Bitcoin rose from $113,863.05 to $114,302.43, closing at $113,983.06.

- The rally surpassed resistance levels at $113,500, $113,650, and $114,000, indicating a potential short-term uptrend.