Bitcoin Miners Approach $40 Billion Market Capitalization Amid Hashrate Growth

Bitcoin miners are nearing a significant milestone with an aggregate market capitalization approaching $40 billion, up from around $20 billion seven months ago. Recent surges in Bitcoin's price have significantly altered financial projections, as highlighted by Farside data.

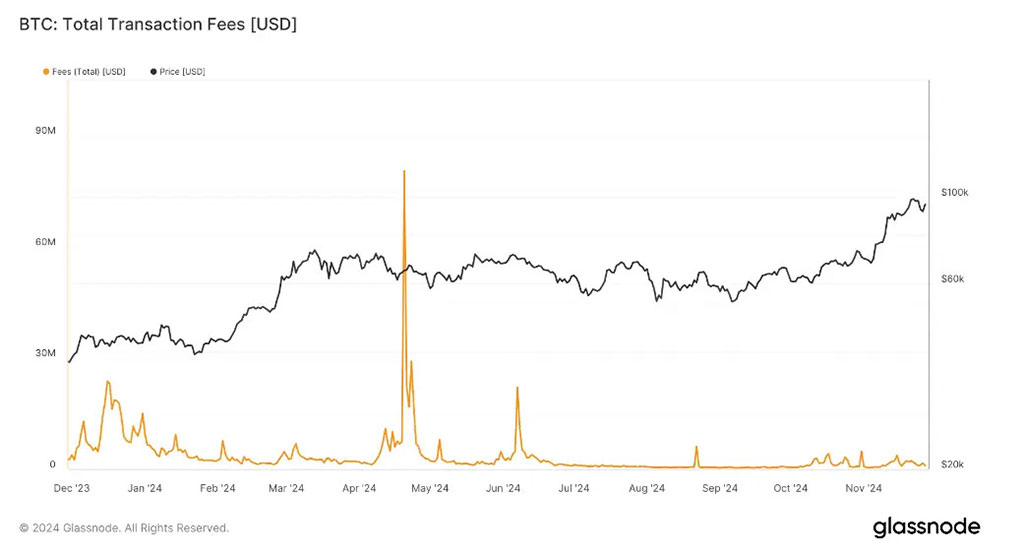

Miners face challenges in maintaining profitability amid volatile conditions. The April blockchain halving event halved block rewards, escalating pressures on the sector. As of November 27, daily bitcoin mining yields only 450 coins, and transaction fees remain under $946,000. Miners must adapt strategically to survive.

-

Photo: Glassnode

- To thrive, miners are exploring alternative revenue streams and optimizing production costs below Bitcoin’s current spot price of approximately $96,000, requiring a reevaluation of traditional mining methods.

Bitcoin Mining Faces Rising Complexity, Resilience Key

Mining difficulty is projected to rise by another 3% soon, surpassing the trillion mark in complexity. This increase presents significant challenges for miners, making block generation costlier and more technically demanding.

The hashrate, which measures the computational power for blockchain transactions, has remained above 700 exahash per second for over a month. Current seven-day moving averages are around 726 EH/s, indicating sustained computational strength since mid-2024. Increased computational power leads to tougher mining conditions.

Miners are diversifying their operations, moving into AI and high-performance computing sectors to capitalize on new opportunities in computing infrastructure hosting. Companies like IREN have seen stock increases of 30%, reflecting market interest in innovative strategies.

MARA's Smart Investment Strategy

Marathon Digital Holdings (MARA) showcases a strategic corporate approach. On November 27, MARA added 703 BTC to its holdings after obtaining a $1 billion convertible note, raising its total to 34,794 BTC, demonstrating a calculated long-term investment strategy.

With our 0% $1 billion convertible notes offering, we are excited to share an update:

– Acquired an additional 703 BTC, bringing the total to 6,474 BTC, at an average price of $95,395 per BTC

– YTD BTC Yield Per Share 36.7%

– Total owned BTC: ~34,794 BTC, currently valued at… pic.twitter.com/bzbunlyBRN— MARA (@MARAHoldings) November 27, 2024

Investment vehicles such as CoinShares Valkyrie Bitcoin Miners ETF illustrate broader market trends, showing a year-to-date performance increase of 60%, though it trails Bitcoin's 113% rise. These metrics are viewed as indicators of industry transformation and potential growth.

The ongoing developments reflect not just cryptocurrency mining but a complex ecosystem of technological innovation, financial strategy, and computational advancement. Miners are evolving from simple blockchain transaction processors to sophisticated technology infrastructure providers.