Bitcoin Miners Sell 25K BTC Worth $2.25 Billion on November 13

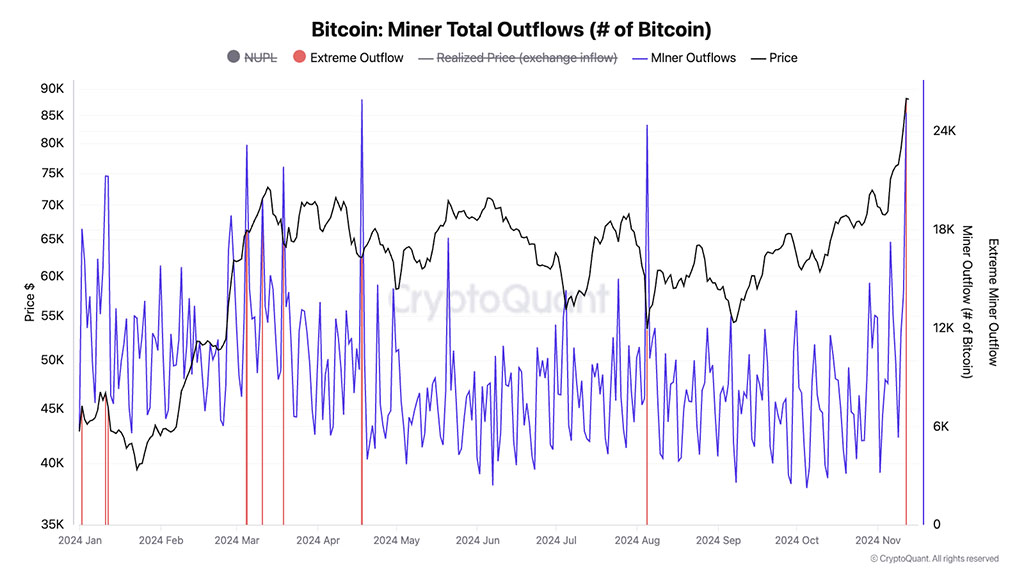

On November 13, Bitcoin miners cashed out as the BTC price reached an all-time high (ATH) of $93.4K. Miners sold 25K BTC coins valued at over $2.25 billion, marking the highest daily sell-off since May 2024, according to CryptoQuant data. This event was indicated by a spike in Miner Total Outflows, which measures BTC transfers from miner wallets to exchanges.

Source: CryptoQuant

Typically, such spikes in miner sell-offs coincide with local price peaks or stalls, as observed in early 2024. The current market sentiment is characterized by euphoria and extreme greed, raising questions about whether historical trends will repeat.

Miners are competing intensely to produce blocks on the Bitcoin network, with mining difficulty surpassing 100 trillion units this week. Despite fierce competition, miners remained profitable, with daily revenue increasing from $29 million to over $40 million in two weeks.

The increase in miner profitability may stem from heightened market interest in BTC following Donald Trump's victory, perceived as favorable for BTC and crypto markets.

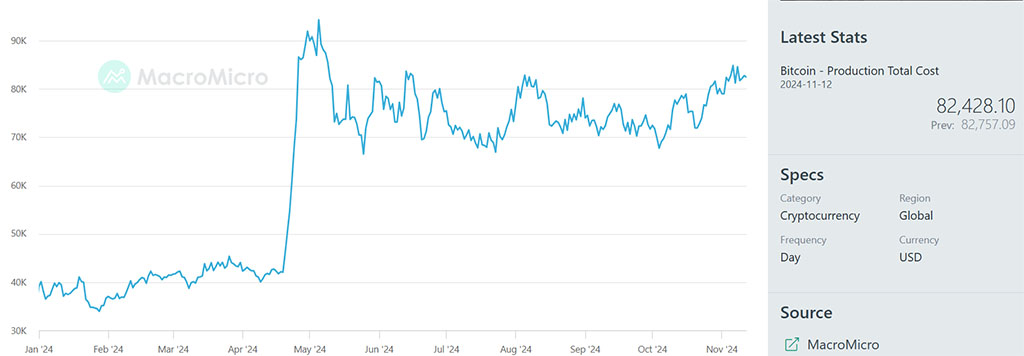

As of November 12, the average cost of mining a single BTC was estimated at $82.4K according to MacroMicro data. With BTC priced at $90K, miners had a positive margin of about $8K, supporting their profitability.

Source: MacroMicro

Is BTC Market Overheated?

Increased miner sell-offs could impact the ongoing BTC rally and affect expectations for reaching the $100K target. Increased miner profitability raises questions about BTC's current valuation.

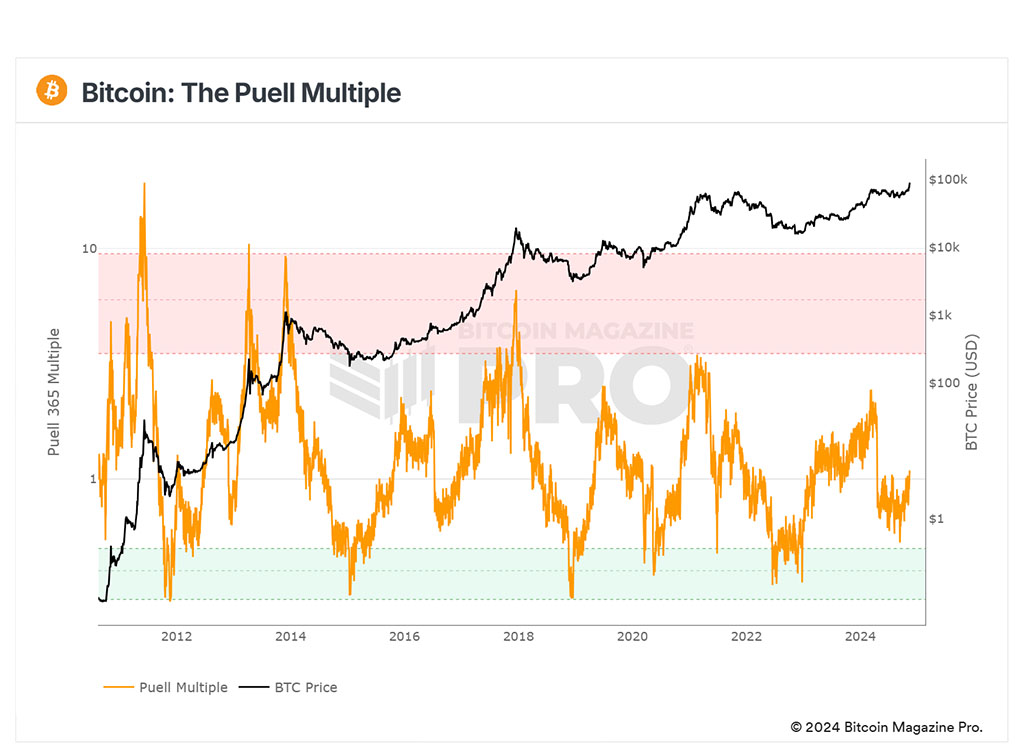

The Puell Multiple, which assesses miner profitability and BTC valuation, suggests room for BTC to continue rising despite exceeding $90K. Historical trends show BTC reaches cycle tops when the Puell Multiple hits between 4 and 10.

At press time, the metric indicated improved miner profitability but stood at 1, suggesting there is considerable potential before reaching the upper band.

Source: BM Pro

The Puell Multiple reflects patterns seen in 2020-2021. In November 2020, the reading was 1 before climbing to the upper band (cycle top of $69K) in early 2021. If this pattern repeats, BTC could reach a cycle top by Q1 2025 based on Puell Multiple analysis.

In summary, BTC does not appear overheated or overvalued despite the current rally to $90K. However, a significant increase in miner sell-offs in early 2025, combined with an overheated Puell Multiple, could warrant monitoring.