Bitcoin Miners Transfer 45,000 BTC to Exchanges in Three Days

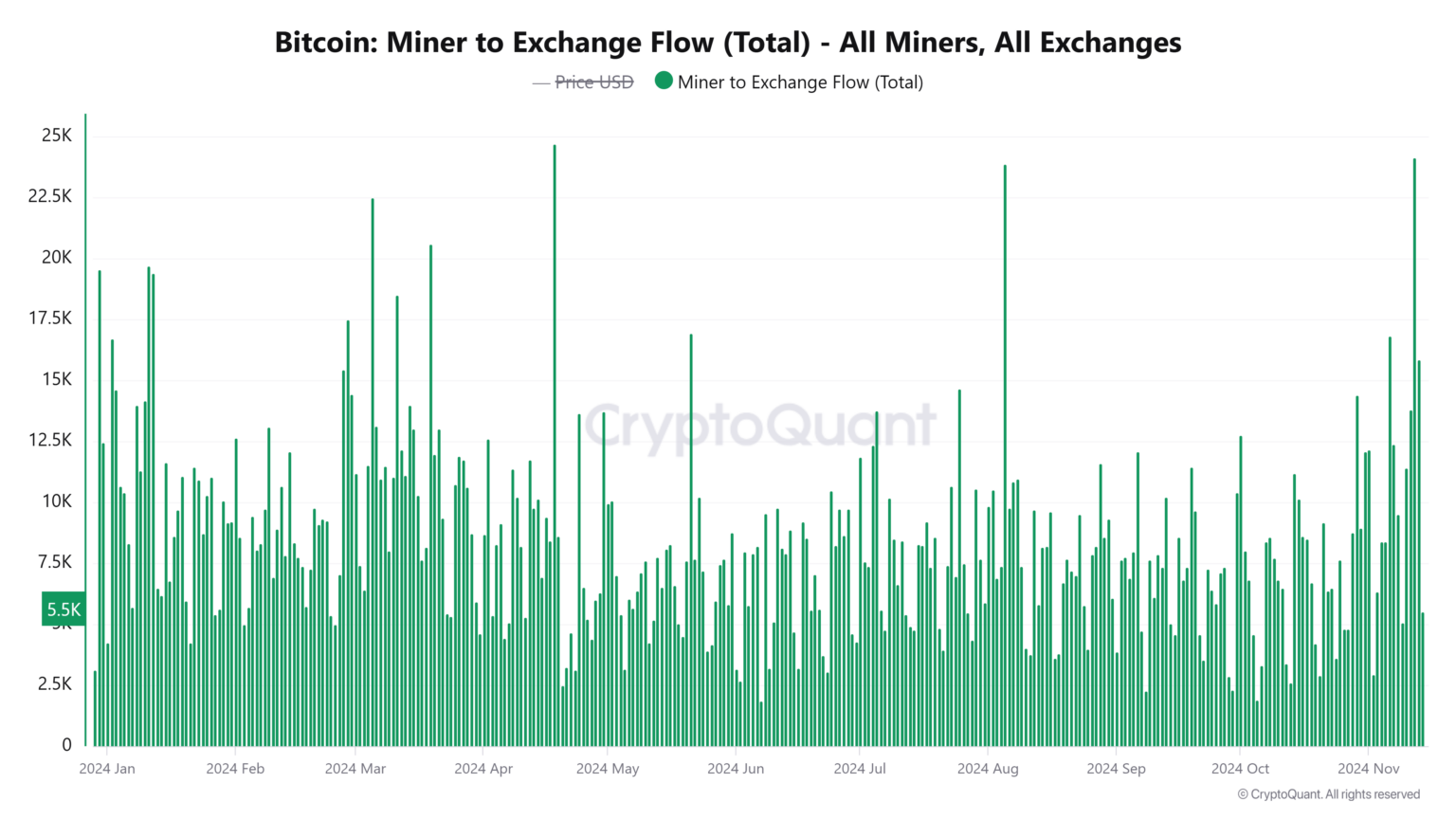

Within three days starting November 12, Bitcoin miners transferred a total of 45,000 BTC to exchanges as Bitcoin's price reached an all-time high above $90,000.

Miner Transactions

On November 12, miners moved 24,138 BTC, marking their second-largest daily outflow this year. The following day, as BTC surged past $93,000, an additional 15,840 BTC was transferred. On November 14, miners shifted another 5,500 BTC, totaling 45,000 BTC over the three-day period.

-

Courtesy: CryptoQuant

Market Implications

Large transfers to exchanges often indicate potential selling intentions by miners, especially during price surges. This coincided with a minor price correction, with Bitcoin briefly dropping below $90,000 and currently trading around $87,000. However, such outflows do not always signal sales; miners may move Bitcoin for operational needs or internal wallet reorganizations.

Additional Factors Influencing Price Movement

Factors beyond miner sell-offs are affecting Bitcoin's price. Recent US inflation data suggests a rise that may hinder future Federal Reserve rate cuts, potentially delaying Bitcoin's rally.

Additionally, whale activity has increased, with one whale depositing 1,920 BTC (approximately $169 million) to Binance. Over three days, this whale deposited a total of 4,060 BTC valued at about $361 million.

A whale deposited 1,920 $BTC($169M) to #Binance 1 hour ago.

The whale has deposited a total of 4,060 $BTC($361M) to #Binance in the past 3 days.https://t.co/8D2y9MbfFn pic.twitter.com/6NlWDPKoVx

— Lookonchain (@lookonchain) November 15, 2024

Market Signals

Ali Martinez reported that $5.42 billion in Bitcoin profits were realized during the price surge, raising the sell-side risk ratio to 0.524%, indicating caution among investors. The Bitcoin RSI indicates the asset is currently in overbought territory, which typically signals a possible price correction.

The daily RSI shows #Bitcoin $BTC is in overbought territory, typically signaling a potential price correction ahead! pic.twitter.com/61k7MXDZia

— Ali (@ali_charts) November 14, 2024

Spot Bitcoin ETFs experienced $400 million in outflows on November 14, following significant inflows after Donald Trump's victory on November 5. BlackRock's Bitcoin ETF (IBIT) attracted $126.5 million, while Fidelity’s FBTC and Ark Invest’s ARKB saw outflows of $100 million each.