Bitcoin Miners Transfer 85,503 BTC in 48 Hours Amid Price Stability

Bitcoin has been a focal point in the crypto market, experiencing significant price fluctuations and mining activity changes. A report from blockchain analytics company Santiment highlights a notable decline in Bitcoin mining balances.

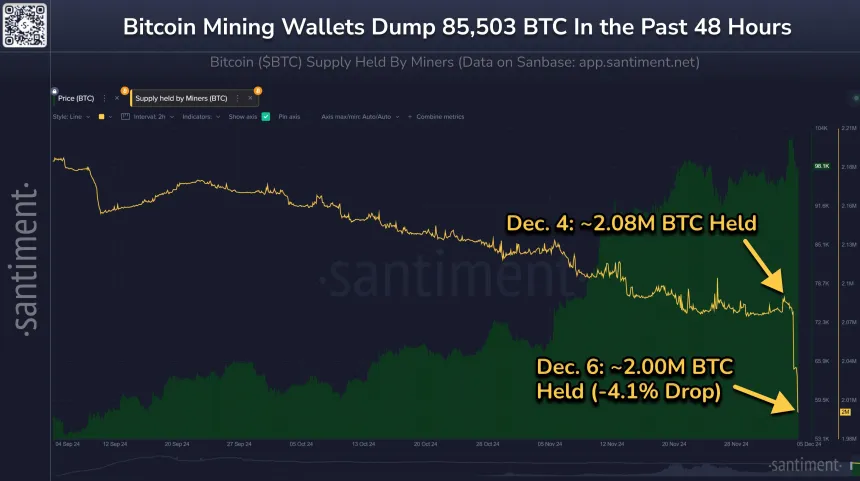

Bitcoin Miners Offload 85,503 BTC In 48 Hours

Santiment reported that Bitcoin mining wallets have seen a consistent decrease since April 2024, indicating miners are selling or transferring their BTC. Recently, these wallets transferred out 85,503 BTC, valued at $8.56 billion, marking the largest drop in miner balances since late February, before Bitcoin's rise to $73,000.

While increased outflows could suggest a bearish trend, Santiment interprets the recent BTC offload as net-neutral regarding price movements. The weak correlation between miner balances and price throughout 2024 further supports this view. Additionally, non-mining investors, referred to as whales and sharks, continue to accumulate Bitcoin, indicating confidence in its profitability despite miner activities.

Crypto analyst Ali Martinez noted that BTC whales acquired 20,000 BTC, valued at $2 billion, within the last 24 hours. However, the ongoing decline in miner balances raises concerns about potential bearish sentiment and speculation on mining profitability, crucial for sustaining the Bitcoin network.

Bitcoin Price Overview

Currently, Bitcoin trades at $100,119, reflecting a 3.67% increase in the past 24 hours. Over larger time frames, Bitcoin shows gains of 2.92% in the last week and 32.60% over the past month. The cryptocurrency is approaching minor resistance at $102,000 after a previous rejection. If bullish momentum continues, Bitcoin may sustain its upward trajectory that began in early October. Historically, Bitcoin tends to gain an average of 38.86% in December, with projections suggesting it could reach as high as $140,000 by the end of 2024.