Bitcoin Mining Costs Rise to $49,500 as Miners Explore AI Solutions

Bitcoin mining has evolved into a competitive, technology-driven industry requiring specialized computer systems, stable internet, reliable energy, and significant technical skills. Miners often rely on credit facilities to fund operations, with current mining costs reaching $49,500 as of the second quarter of 2023, up from an average of $47,200 in the first quarter.

CoinShares reports that miners' cash expenses average $85,900, with predicted costs at $96,100. Many miners report difficulties securing credit lines, exacerbated by rising interest rates.

BTC Miners Fail To Capitalize On Recent Price Rallies

The volatility of Bitcoin affects mining profitability. Miners struggled to capitalize on speculation surrounding Bitcoin ETFs in late 2023. Following the SEC's approval of 11 ETF applications in January 2024, Bitcoin prices exceeded $70,000, highlighting the industry's sensitivity to price fluctuations, particularly after the halving of rewards.

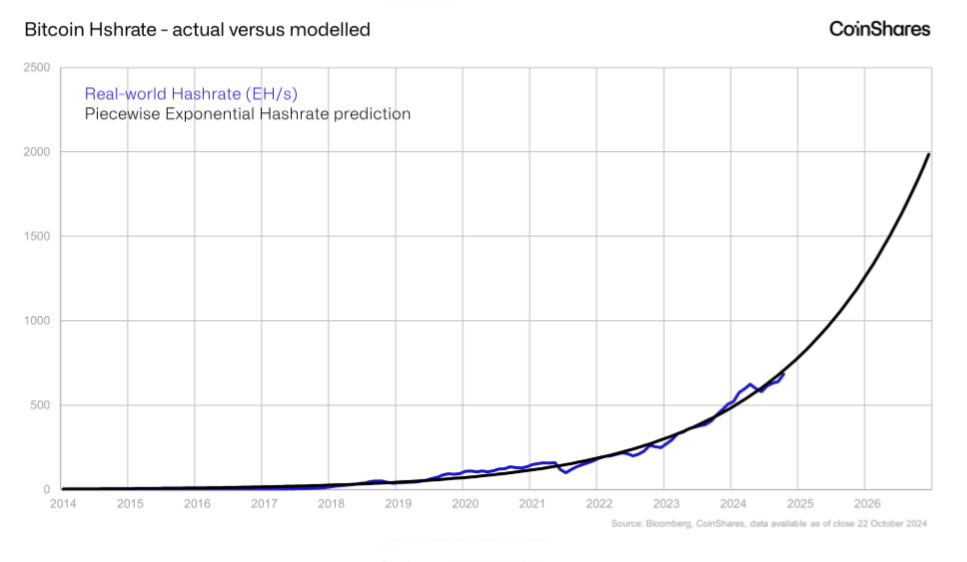

Mining analysts are developing models to forecast hash rate increases, with expectations for it to reach 765 EH/s.

Time For BTC Mining To Embrace Alternative Energy Sources?

Critics point out the environmental impact of Bitcoin mining due to its high energy consumption. Experts suggest that utilizing alternative energy sources could reduce carbon footprints by 63% by 2050. As hash rates increase, miners should consider adopting these energy solutions to manage rising costs.

As Costs Rise, Some Bitcoin Miners Turn To AI

With declining mining efficiency, some miners are exploring revenue augmentation strategies. Experienced miners may hold tokens instead of mining them, while others investigate AI-related solutions. The BTC mining industry is entering a new phase where stakeholders must navigate challenges related to costs, compliance, and competition to maintain profitability.

Featured image from Dall-E, chart from TradingView