Bitcoin Mining Dynamics Shift as Price Dependency Decreases in 2025

Bitcoin Mining Update

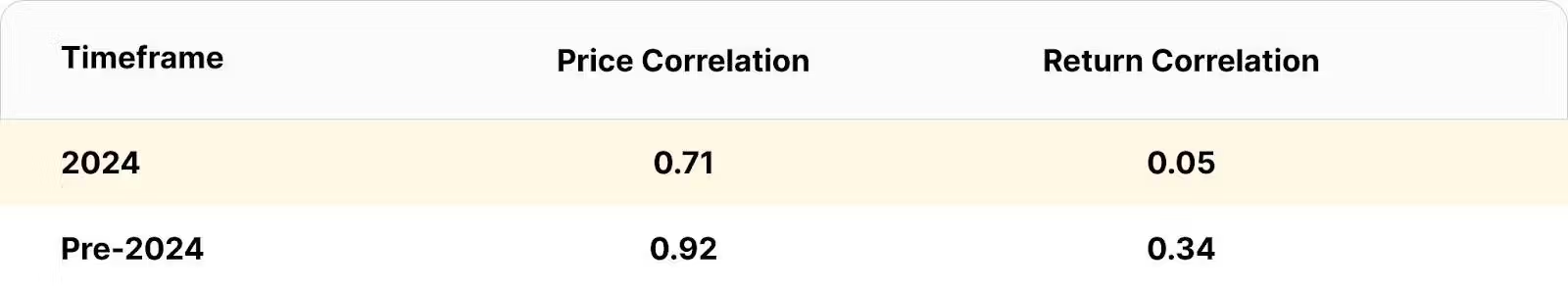

In 2024, the dynamics of bitcoin mining have shifted significantly, moving beyond a simple correlation with bitcoin's price. Key trends influencing this change include:

- Institutional Bitcoin Adoption: The launch of spot bitcoin ETFs in January 2024 attracted over 1.3 million BTC, reducing the reliance on mining stocks as proxies for bitcoin.

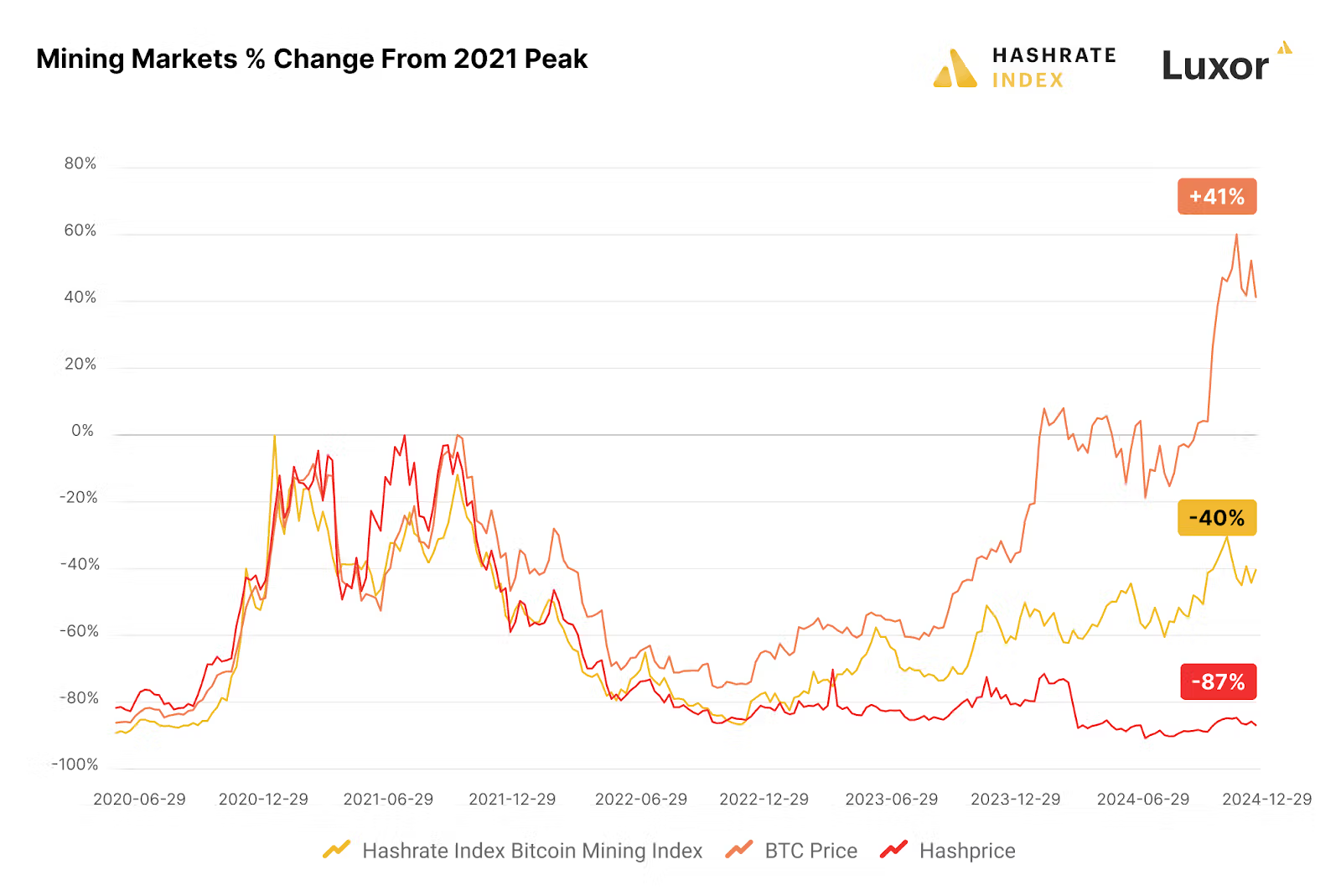

- Halving Impact: The April 2024 halving cut miner rewards by 50%, introducing challenges like high network difficulty and decreased transaction fees, despite a 120% rise in bitcoin's price.

- Hashrate Derivatives Growth: The hashrate derivatives market expanded rapidly, allowing miners to hedge revenue streams and manage risk more effectively, with OTC volumes increasing over 500% year-over-year.

- AI and HPC Integration: Miners are diversifying into AI and high-performance computing sectors, leveraging existing infrastructure while facing higher costs associated with AI operations.

The convergence of these factors indicates that bitcoin mining is evolving into a more complex investment landscape, necessitating a nuanced understanding of market shifts for investors.

Expert Insights

Bitcoin miners are actively exploring AI markets, with companies like Hut 8 and Bit Digital acquiring data center businesses. Others, such as Riot and Cipher, are evaluating their infrastructure for AI compatibility.

While many miners continue to focus on bitcoin, the integration of AI and HPC represents a complementary strategy rather than a competitive one, allowing them to utilize energy costs effectively during low demand periods.