9 0

Bitcoin Momentum Reset Amid Market Collapse and Liquidations

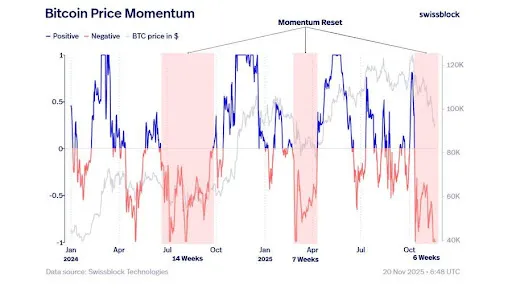

The Bitcoin market is experiencing a momentum reset, typical of the cooling phase between major trend cycles. This phase allows for re-evaluation after previous movements have subsided.

Recent Developments

- Swissblock notes that Bitcoin's momentum is resetting, with historical patterns suggesting a 7 to 14-week duration for full resets.

- Data indicates the current reset phase has been ongoing for weeks, entering a zone where past cycles typically showed exhaustion and increased chances of counter-trend moves.

On October 6th, Bitcoin reached an all-time high of $126,272, and the crypto market capitalization hit $2.5 trillion. However, a significant shift occurred on October 10th when tariffs were threatened by President Trump, leading to $19.2 billion in liquidations. BTC has struggled to recover since.

Current Market Conditions

- This correction aligns with previous major drawdowns, exacerbated by high leverage and liquidation events.

- The recent event not only affected Bitcoin but also severely impacted altcoins, while equities and metals reached new highs.

The absence of bearish fundamentals indicates a mechanical bear market driven by leverage, with expectations for market self-correction.