5 0

Bitcoin Momentum May Be Waning Amid Low New Investor Participation

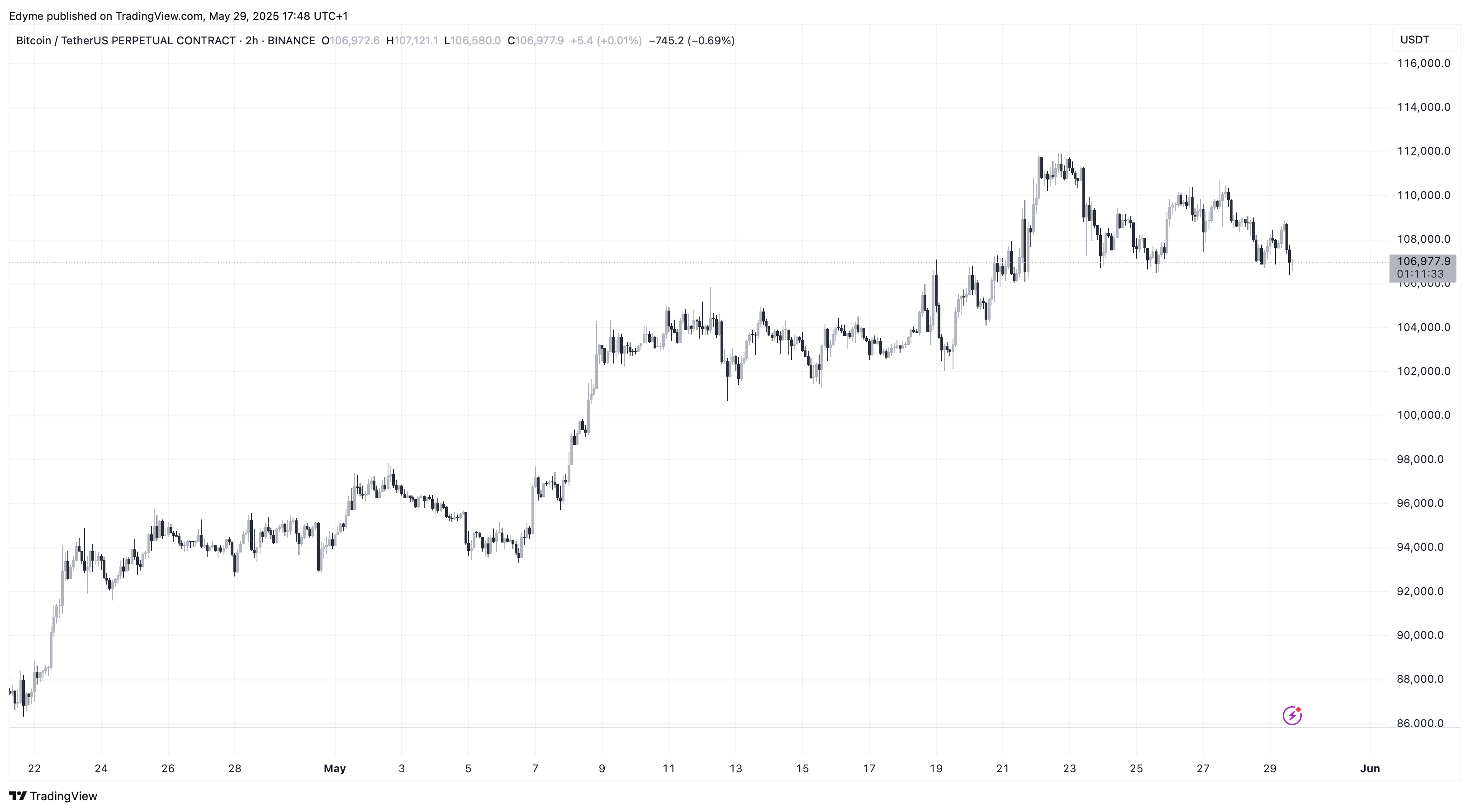

Bitcoin is trading above $107,000 after hitting a new all-time high over $111,000. Despite a 3.9% drop from this peak, BTC has gained over 10% in the past month. Market focus is shifting from price to on-chain dynamics, particularly regarding holder behavior.

Bitcoin Long-Term Holders Selling, New Entrants Still Cautious

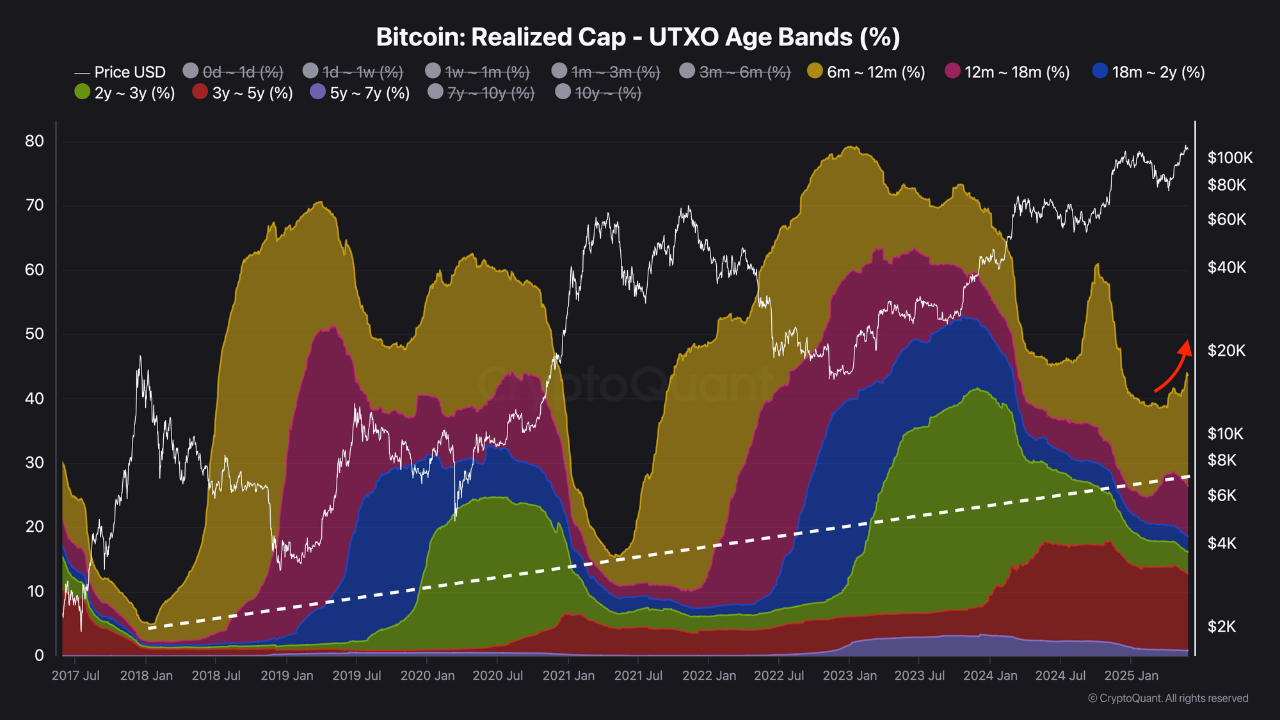

- On-chain analyst Avocado Onchain analyzed UTXO data to assess current investor trends.

- The post suggests that older coins are being sold while inflows of new investors remain low.

- A significant portion of BTC supply is held by those with positions over six months.

- The 6–12 month age band of holders is increasing, indicating mid- to long-term holding patterns.

- Historically, shrinking long-term holder percentages precede major price tops.

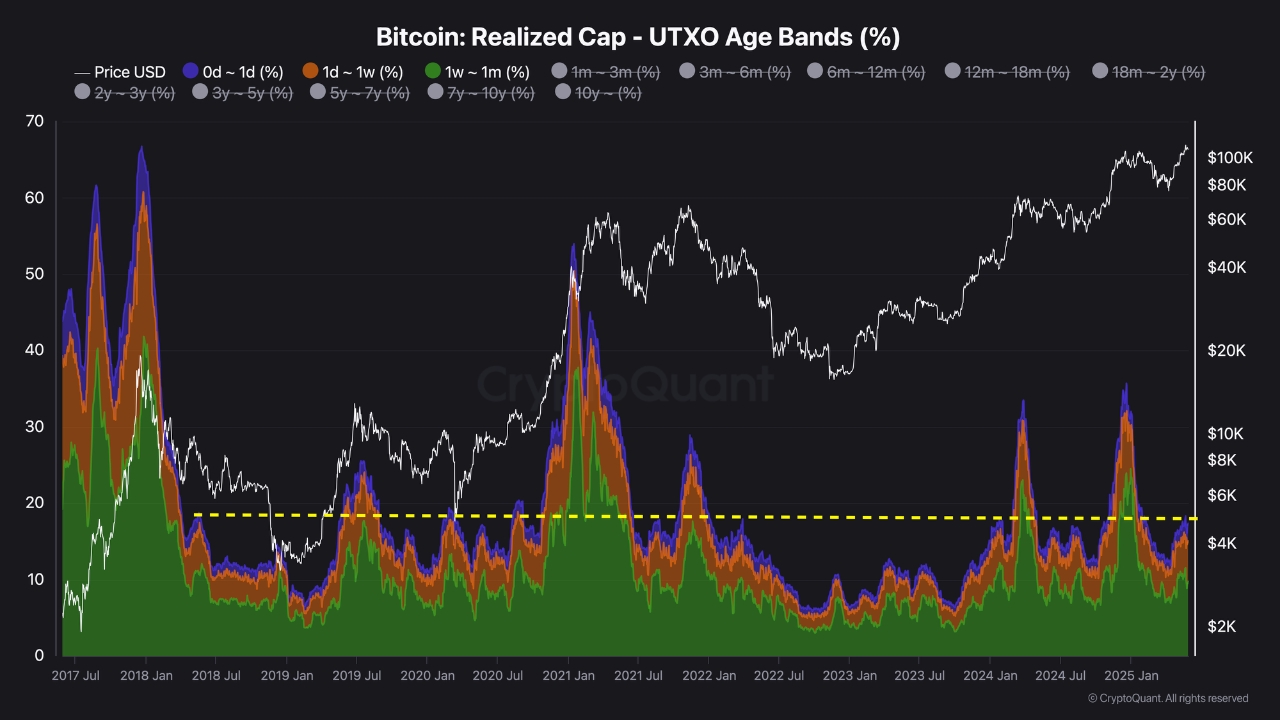

- The current percentage of UTXOs held for less than one month is below historical thresholds seen near previous market peaks.

- New investor participation is currently around 20%, lower than during earlier bull cycles.

- Without increased participation from new investors, momentum may falter.

Large Holders Accumulate as Retail Stays on Sidelines

- While retail inflows are lacking, large holders are accumulating BTC.

- Addresses holding between 1,000 and 10,000 BTC are rising, indicating growing confidence among large investors.

- This accumulation is often linked to institutional activity, which may provide price support.

- The market is currently in a transitional phase, with potential upside if broader participation increases.